Question: Scenario: The Assignment requires an analysis of specific financial data of Bob Smith Inc. Bob is an existing bank customer. When the loan to Bob

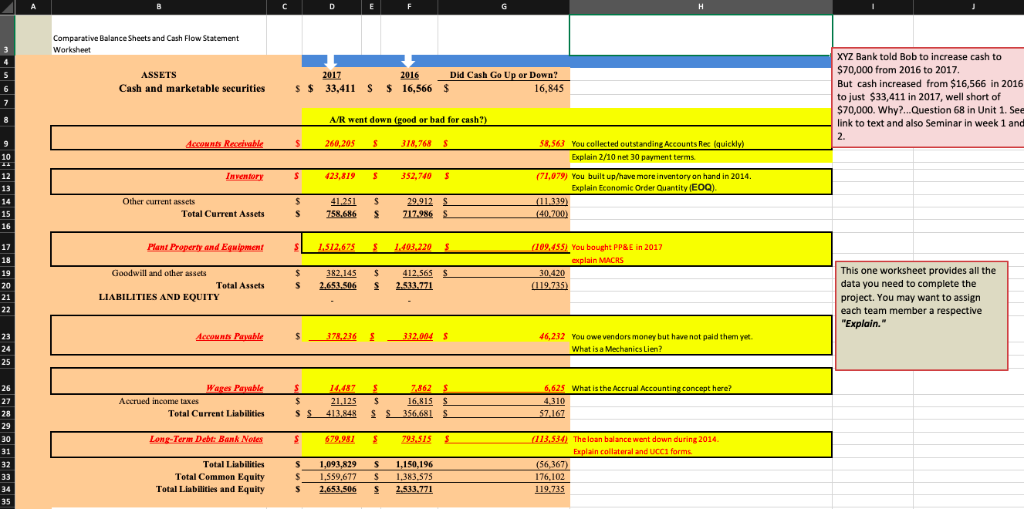

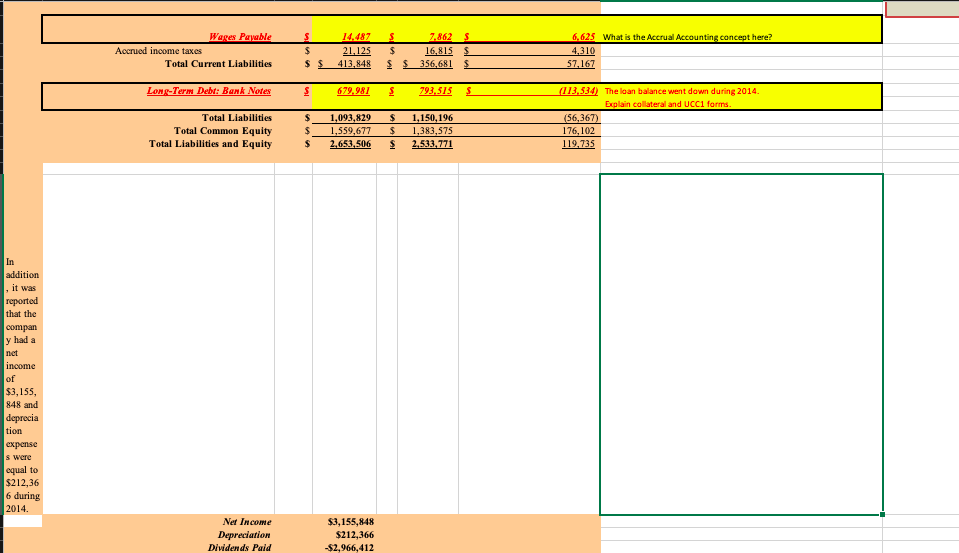

Scenario: The Assignment requires an analysis of specific financial data of Bob Smith Inc. Bob is an existing bank customer. When the loan to Bob was originally made in 2016 the bank required Bob to increase the YE 2016 cash balance to at least $70,000 by YE 2017. The Cash Flow Statement and Balance Sheet show an actual YE 2017 cash balance of less than $34,000.

The Assignment requires participation in a team effort to complete the (partially prepared) 2017 Cash Flow Statement. In Seminar 1 you discussed how to complete and use the 2017 Cash Flow Statement outcomes to explain how specific accounts influenced Bobs low cash balancesin other words, some reasons why Bob has no cash!

This information allows you to substantiate the 2018 loan denial. You are aware this action will create dire financial circumstances for Bobs company. As the loan officer, you must pass along the news in a business letter that is most professional and written in an objective manner. Please use the values in the letter whenever possible.

Comparative Balance Sheets and Cash Flow Statement XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017, But cash increased from $16,566 in 2016 to just $33,411 in 2017, well short of $70,000. Why?..Question 68 in Unit 1. See link to text and also Seminar in week 1 and 2. ASSETS Did Cash Go Up or Down? Cash and marketable securities $ 33,411 S s 16,566 16,845 A/R went down or bad for cash?) 260,205 S318,768 S 58,563 You collected outstanding Accounts Rec (quickly) Explain 2/10 net 30 payment terms 12 Inventory 423,819S 352,740 S (71,079) You built up/have more inventory on hand in 2014. 13 Explain Economic Order Quantity(E Other current assets 41,251 S 15 S 258686 S 217,986 S 140.200 17 09 455) You bought PP&E in 2017 xplain MACRS This one worksheet provides all the data you need to complete the project. You may want to assign each team member a respective Explain." Goodwill and other assets 382.145 S 412565 S30.420 19 20 Total Assets S 2653 506 S 2533.771 LIABILITIES AND EQUITY 23 Acconnts Pawhle 378236332004S 46,232 You owe vendors money but have not paid them yet. What is a s Lien? 25 Wa 7.862 6,625 What is the Accrual Accounting concept here? Accrued income taxes 21,125 S t Liabiities 413848 S S16815 Total Current I 29 LontTernlehtBankNote! 672.981 S 793,515 13,5342 The loan balance went down during 2014 Explain collateral and UCC1 forms Total Liabilities Total Common Equity Total Liabilities and Equity 29 S ,150,196 S 1,559,677 1,383,575 S 2,653.506 2533.771 Wages PayaWe 7862 S 6,625 What is the Accrual Accountin t here? Accrued income taxes 21125 $ 16.815 Total Current LiabilitiesS $ 413.848 356.681 679.981 793.515 $ 1,093,829 1,150,196 Term Debt: Bank N 113,534) The loan balance went down during 2014. Explain collateral and UCC1 forms Total Liabilities 36 Total Common Equity Total Liabilities and Equity 1,559.677 S1.383.575176.102 119.735 it was that the y had a $3,155, 848 and s were equal to $212,36 6 during 2014. Net Income $3,155,848 $212,366 -$2,966,412 Dividends Paid Comparative Balance Sheets and Cash Flow Statement XYZ Bank told Bob to increase cash to $70,000 from 2016 to 2017, But cash increased from $16,566 in 2016 to just $33,411 in 2017, well short of $70,000. Why?..Question 68 in Unit 1. See link to text and also Seminar in week 1 and 2. ASSETS Did Cash Go Up or Down? Cash and marketable securities $ 33,411 S s 16,566 16,845 A/R went down or bad for cash?) 260,205 S318,768 S 58,563 You collected outstanding Accounts Rec (quickly) Explain 2/10 net 30 payment terms 12 Inventory 423,819S 352,740 S (71,079) You built up/have more inventory on hand in 2014. 13 Explain Economic Order Quantity(E Other current assets 41,251 S 15 S 258686 S 217,986 S 140.200 17 09 455) You bought PP&E in 2017 xplain MACRS This one worksheet provides all the data you need to complete the project. You may want to assign each team member a respective Explain." Goodwill and other assets 382.145 S 412565 S30.420 19 20 Total Assets S 2653 506 S 2533.771 LIABILITIES AND EQUITY 23 Acconnts Pawhle 378236332004S 46,232 You owe vendors money but have not paid them yet. What is a s Lien? 25 Wa 7.862 6,625 What is the Accrual Accounting concept here? Accrued income taxes 21,125 S t Liabiities 413848 S S16815 Total Current I 29 LontTernlehtBankNote! 672.981 S 793,515 13,5342 The loan balance went down during 2014 Explain collateral and UCC1 forms Total Liabilities Total Common Equity Total Liabilities and Equity 29 S ,150,196 S 1,559,677 1,383,575 S 2,653.506 2533.771 Wages PayaWe 7862 S 6,625 What is the Accrual Accountin t here? Accrued income taxes 21125 $ 16.815 Total Current LiabilitiesS $ 413.848 356.681 679.981 793.515 $ 1,093,829 1,150,196 Term Debt: Bank N 113,534) The loan balance went down during 2014. Explain collateral and UCC1 forms Total Liabilities 36 Total Common Equity Total Liabilities and Equity 1,559.677 S1.383.575176.102 119.735 it was that the y had a $3,155, 848 and s were equal to $212,36 6 during 2014. Net Income $3,155,848 $212,366 -$2,966,412 Dividends Paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts