Question: Scenarlo Two James has worked full time as an entry-level web designer since earning his certification. He earns $47,000 a year and rents an apartment

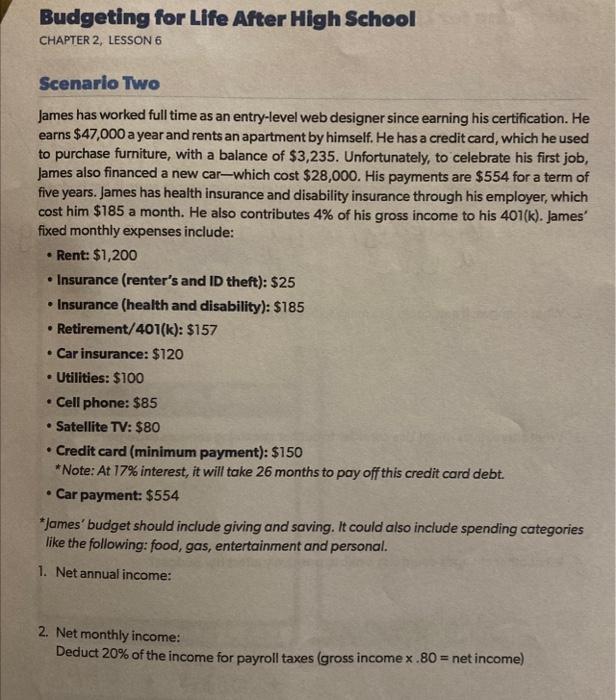

Scenarlo Two James has worked full time as an entry-level web designer since earning his certification. He earns $47,000 a year and rents an apartment by himself. He has a credit card, which he used to purchase furniture, with a balance of $3,235. Unfortunately, to celebrate his first job, James also financed a new car-which cost $28,000. His payments are $554 for a term of five years. James has health insurance and disability insurance through his employer, which cost him $185 a month. He also contributes 4% of his gross income to his 401(k). James' fixed monthly expenses include: - Rent: $1,200 - Insurance (renter's and ID theft): $25 - Insurance (health and disability): $185 - Retirement/401(k): \$157 - Car insurance: $120 - Utilities: $100 - Cell phone: $85 - Satellite TV: $80 - Credit card (minimum payment): $150 * Note: At 17% interest, it will take 26 months to pay off this credit card debt. - Car payment: $554 `James' budget should include giving and saving. It could also include spending categories like the following: food, gas, entertainment and personal. 1. Net annual income: 2. Net monthly income: Deduct 20% of the income for payroll taxes (gross income x.80= net income)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts