Question: SCHOOL Help Me A stock is expected to pay its first 561 dividend in 4 years from now. The dividend is expected to be paid

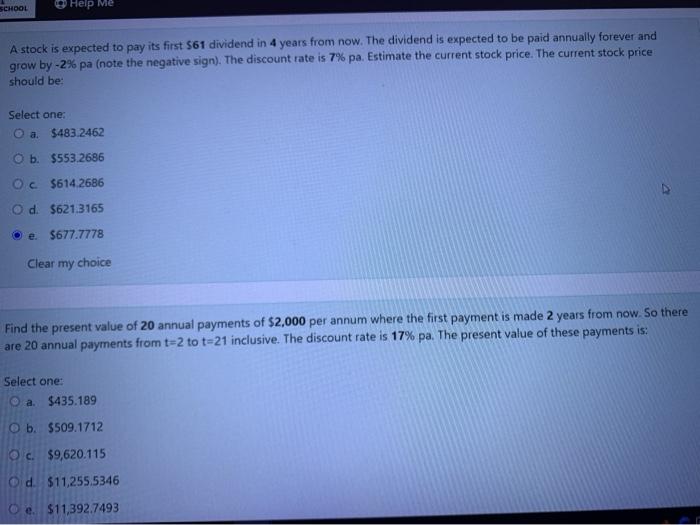

SCHOOL Help Me A stock is expected to pay its first 561 dividend in 4 years from now. The dividend is expected to be paid annually forever and grow by -2% pa (note the negative sign). The discount rate is 7% pa. Estimate the current stock price. The current stock price should be: Select one: O a. $483.2462 O b. $553.2686 Oc $6142686 Od $621.3165 e $677.7778 Clear my choice Find the present value of 20 annual payments of $2,000 per annum where the first payment is made 2 years from now. So there are 20 annual payments from t=2 to t=21 inclusive. The discount rate is 17% pa. The present value of these payments is: Select one: O a $435.189 O b. $509.1712 c. $9,620.115 Od $11,255,5346 Oe. $11,392.7493

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts