Question: Score X B19-15 (book/static) Approximately what expected future long-run growth rate would provide the same EBITDA multiple in 2010 as Ideko has in 2005 (ie.,

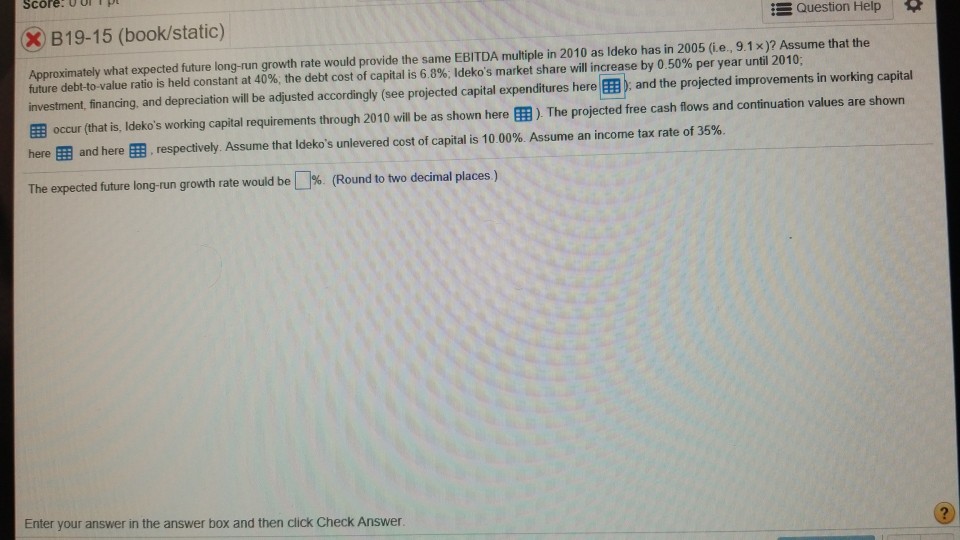

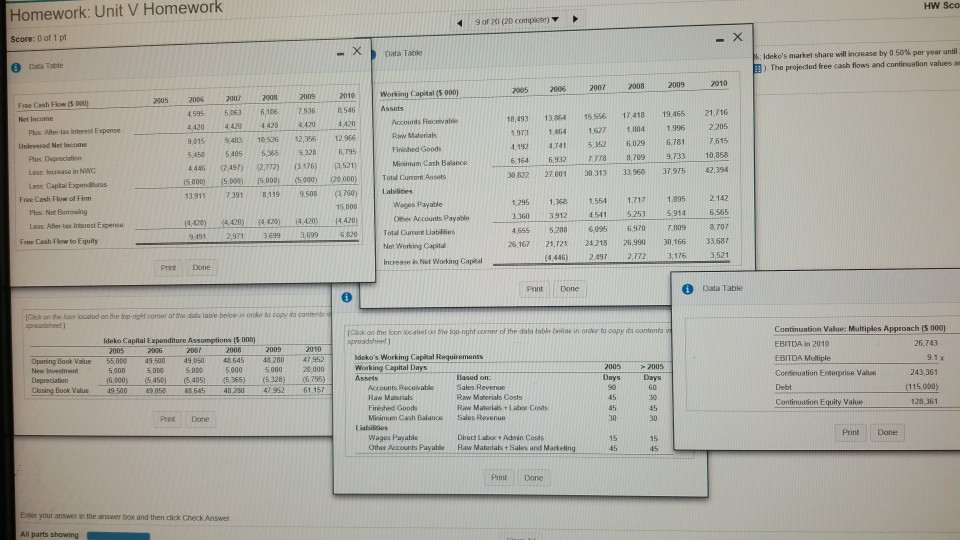

Score X B19-15 (book/static) Approximately what expected future long-run growth rate would provide the same EBITDA multiple in 2010 as Ideko has in 2005 (ie., 9.1x)? Assume that the E Question Help future debt-to-value ratio is held constant at 40%, the debt cost of capital is 6 8%, Idek 's market share will increase by 050% per year until 2010 investment financing, and depreciation will be adjusted accordingly (se projected capital expenditures here EB) and the projected improvements in working capital EE occur (that is, Ideko's working capital requirements through 2010 will be as shown here EB) The projected free cash flows and continuation values are shown hereand here respectively. Assume that ldeko's unlevered cost of capital s 10 00%. Assume an income tax rate of 35% The expected future long-run growth rate would be % (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer Score X B19-15 (book/static) Approximately what expected future long-run growth rate would provide the same EBITDA multiple in 2010 as Ideko has in 2005 (ie., 9.1x)? Assume that the E Question Help future debt-to-value ratio is held constant at 40%, the debt cost of capital is 6 8%, Idek 's market share will increase by 050% per year until 2010 investment financing, and depreciation will be adjusted accordingly (se projected capital expenditures here EB) and the projected improvements in working capital EE occur (that is, Ideko's working capital requirements through 2010 will be as shown here EB) The projected free cash flows and continuation values are shown hereand here respectively. Assume that ldeko's unlevered cost of capital s 10 00%. Assume an income tax rate of 35% The expected future long-run growth rate would be % (Round to two decimal places.) Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts