Question: SD24: Write Cheque Dated June 20, 2021 To pay for purchase received with Bill #OE-216 from Office Essentials for $240.00 plus $36.00 HST for printer

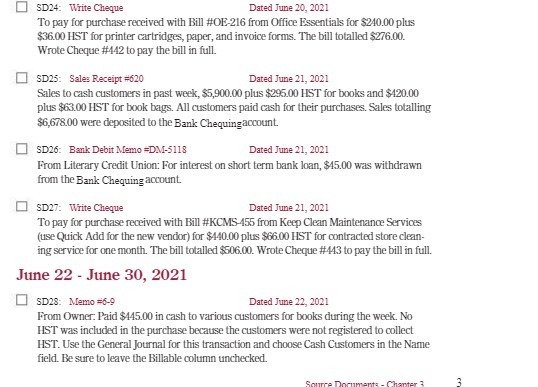

SD24: Write Cheque Dated June 20, 2021 To pay for purchase received with Bill #OE-216 from Office Essentials for $240.00 plus $36.00 HST for printer cartridges, paper, and invoice forms. The bill totalled $276.00. Wrote Cheque #442 to pay the bill in full. SD25: Sales Receipt #620 Dated June 21, 2021 Sales to cash customers in past week, $5,900.00 plus $295.00 HST for books and $420.00 plus $63.00 HST for book bags. All customers paid cash for their purchases. Sales totalling $6,678.00 were deposited to the Bank Chequing account SD26: Bank Debit Memo =DM-5118 Dated June 21, 2021 From Literary Credit Union: For interest on short term bank loan, $45.00 was withdrawn from the Bank Chequing account SD27: Write Cheque Dated June 21, 2021 To pay for purchase received with Bill #KCMS-455 from Keep Clean Maintenance Services (use Quick Add for the new vendor) for $440.00 plus $66.00 HST for contracted store clean- ing service for one month. The bill totalled $506.00. Wrote Cheque #443 to pay the bill in full. June 22 - June 30, 2021 SD28: Memo =6-9 Dated June 22, 2021 From Owner: Paid $145.00 in cash to various customers for books during the week. No HST was included in the purchase because the customers were not registered to collect HST. Use the General Journal for this transaction and choose Cash Customers in the Name field. Be sure to leave the Billable column unchecked. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts