Question: Search entries or author Unread 19 Edit View Insert Format Tools Table 12pt Paragraph BI U ALTY de 8-1. What limits are imposed on the

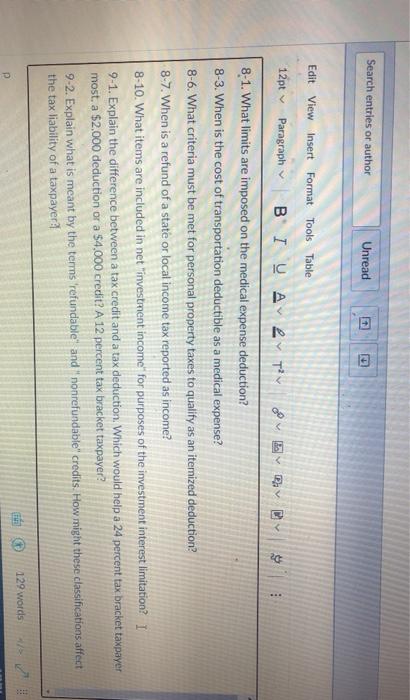

Search entries or author Unread 19 Edit View Insert Format Tools Table 12pt Paragraph BI U ALTY de 8-1. What limits are imposed on the medical expense deduction? 8-3. When is the cost of transportation deductible as a medical expense? 8-6. What criteria must be met for personal property taxes to qualify as an iternized deduction? 8-7. When is a refund of a state or local income tax reported as income? 8-10. What items are included in net investment income" for purposes of the investment interest limitation? I 9-1. Explain the difference between a tax credit and a tax deduction. Which would help a 24 percent tax bracket taxpayer most, a $2.000 deduction or a $4,000 credit? A 12 percent tax bracket taxpayer? 9-2. Explain what is meant by the terms 'refundable" and " nonrefundable" credits. How might these classifications affect the tax liability of a taxpayer? 129 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts