Question: Search this course Ch 07: End-of-Chapter Problems Bonds and Thelt Valuation Back to Assignment und Study Tools Attempts Keep the highest / 2 9. Problem

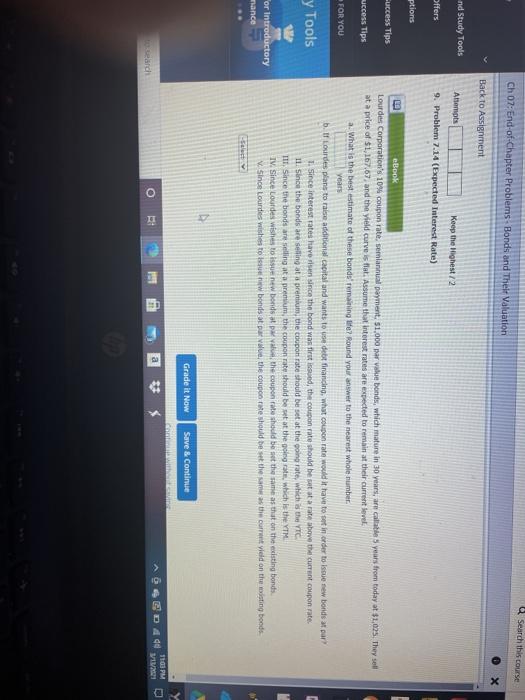

Search this course Ch 07: End-of-Chapter Problems Bonds and Thelt Valuation Back to Assignment und Study Tools Attempts Keep the highest / 2 9. Problem 7.14 (Expected laterest Rate) Offers ptions Cuccess Tips success Tips FOR YOU y Tools eBook Lourdes Corporation's 10% coupon rate, selannual payment. 51,000 wale bonds, which mature in 30 years, a calitate 5 years from today at $1,025 They sell at a price of $1,167.67 and the yield curve is flat. Assume that interest rates are expected to remain at their current level a. What is the best estimate of these bondel remaining life? Round your answer to the nearest whole number Years b. If Lourdes plans to raise additional capital and wants to use debt financing, what coupon rate would it have to be in order to issue new bonds as par 1. Since interest rates have risen since the bond wasted, the coupon rate should be stata rate above the current coupon rate. Il. Since the boods are selling at pretium, the coupon rate should be set at the poing rate which they III. Since the bonds are selling at a premium, the coupon rate should be set at the going rate, which is the YTM IV. Since Lourdes wishes to new bonds at the coupon rate should be set the same as that on the existing bonds Since Lourdes wishes to bondsot par value the coupon rate should be set the the curret ved on the waiting boods Selet or introductory nance Grade it Now Save & Continue attains 11:00 PM VI/1 CD 440 O 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts