Question: Search this course Ch 07-End-of-Chapter Problems - Bonds and Their Valuation Keep the Highest! 6. Problem 7.06 (Band Valuation) Ampte A-Z ebook Problem Wale-Through An

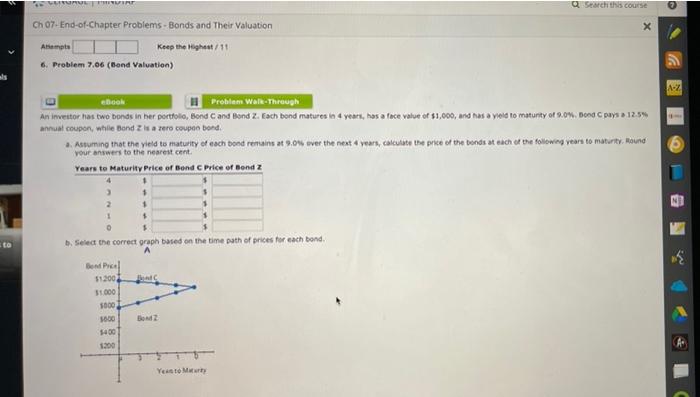

Search this course Ch 07-End-of-Chapter Problems - Bonds and Their Valuation Keep the Highest! 6. Problem 7.06 (Band Valuation) Ampte A-Z ebook Problem Wale-Through An investor has two bonds in her portfolio, Bond Cand Bond 2. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 9,0% Bond C pays > 12.5% annual coupon, while Bond is a ser coupon bond Assuming that the yield to maturity of each bond remains to ever the next years, calculate the price of the bonds at each of the following years to maturity. Hound your answers to the nearest cent Years to Maturity Price of Bond C Price of Bond z 2 1 5 0 1. Select the correct graph based on the time path of prices for each bond. 5 to BordPrel 51.200 31000 5000 3600 5400 1300 BOZ Yess to Me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts