Question: seasonal van de predetermine 3-3 de Corting Celting in protests 5. units, what is the unit product cost for this job! lises a markup percentage

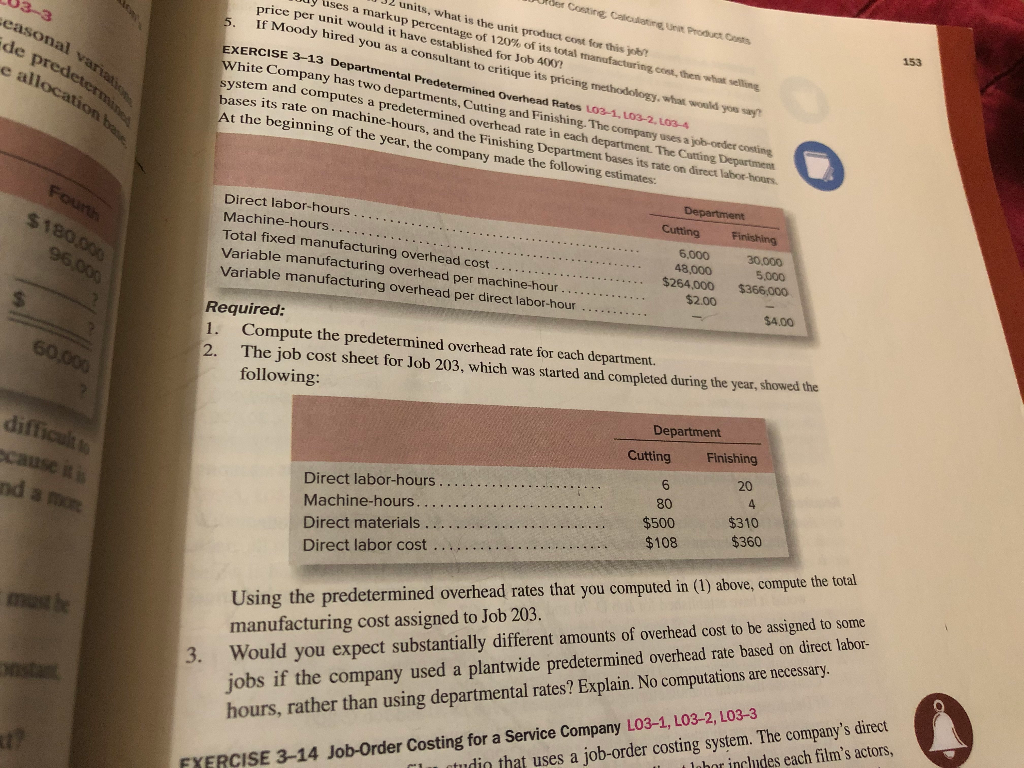

seasonal van de predetermine 3-3 de Corting Celting in protests 5. units, what is the unit product cost for this job! lises a markup percentage of 120% of its total manufacturing, cred, then what selling price per unit would it have established for Job 40W? If Moody hired you as a consultant to critique its pricing methodology, what would you say? EXERCISE 3-13 Departmental Predetermined Overhead Rates 103-1, L03-2,103-4 White Company has two departments, Cutting and Finishing. The company uses a job-order casting system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department bases its rate on direct laber-hours. At the beginning of the year, the company made the following estimates. 153 e allocation be Fourth $180.000 96.000 Direct labor-hours Machine-hours................... Total fixed manufacturing overhead cost ....... Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour ........... $ Department Cutting Finishing 6.000 30.000 48,000 5.000 $264,000 $366,000 $2.00 $4.00 Required: 1. Compute the predetermined overhead rate for each department 2. The job cost sheet for Job 203, which was started and completed during the year, showed the following: Department Cutting Finishing 60.000 difficult ecause it nd a more Direct labor-hours Machine-hours. Direct materials Direct labor cost 6 80 $500 $108 20 4 $310 $360 3. Using the predetermined overhead rates that you computed in (1) above, compute the total manufacturing cost assigned to Job 203. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined overhead rate based on direct labor- hours, rather than using departmental rates? Explain. No computations are necessary. FXERCISE 3-14 Job-Order Costing for a Service Company L03-1, L03-2, L03-3 u studin that uses a job-order costing system. The company's direct Lohor includes each film's actors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts