Question: Second Link Services granted restricted stock units (RSU) representing 12 million of its $1 par common shares to executives, subject to forfeiture if employment is

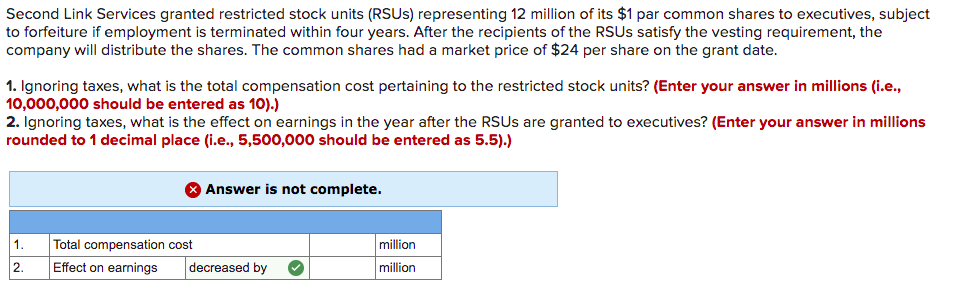

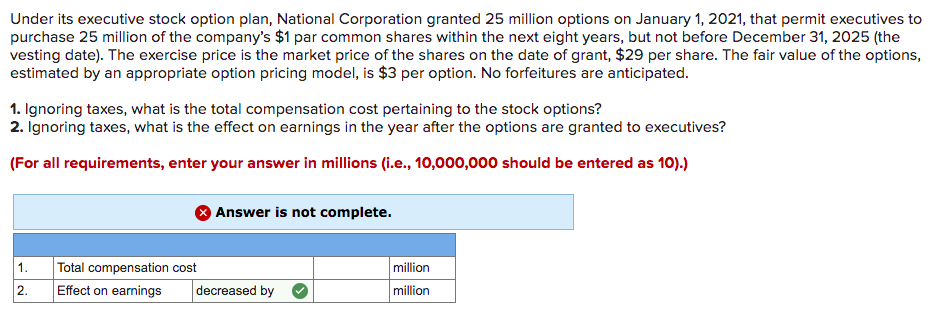

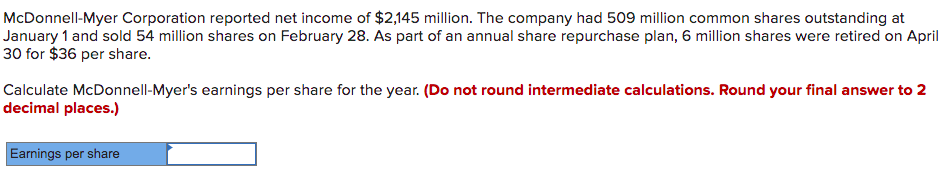

Second Link Services granted restricted stock units (RSU) representing 12 million of its $1 par common shares to executives, subject to forfeiture if employment is terminated within four years. After the recipients of the RSUS satisfy the vesting requirement, the company will distribute the shares. The common shares had a market price of $24 per share on the grant date. 1. Ignoring taxes, what is the total compensation cost pertaining to the restricted stock units? (Enter your answer in millions (i.e., 10,000,000 should be entered as 10).) 2. Ignoring taxes, what is the effect on earnings in the year after the RSUs are granted to executives? (Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Answer is not complete. 1. Total compensation cost Effect on earnings decreased by million million 2. Under its executive stock option plan, National Corporation granted 25 million options on January 1, 2021, that permit executives to purchase 25 million of the company's $1 par common shares within the next eight years, but not before December 31, 2025 (the vesting date). The exercise price is the market price of the shares on the date of grant, $29 per share. The fair value of the options, estimated by an appropriate option pricing model, is $3 per option. No forfeitures are anticipated. 1. Ignoring taxes, what is the total compensation cost pertaining to the stock options? 2. Ignoring taxes, what is the effect on earnings in the year after the options are granted to executives? (For all requirements, enter your answer in millions (i.e., 10,000,000 should be entered as 10).) Answer is not complete. 1. Total compensation cost Effect on earnings decreased by million million 2. McDonnell-Myer Corporation reported net income of $2,145 million. The company had 509 million common shares outstanding at January 1 and sold 54 million shares on February 28. As part of an annual share repurchase plan, 6 million shares were retired on April 30 for $36 per share. Calculate McDonnell-Myer's earnings per share for the year. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts