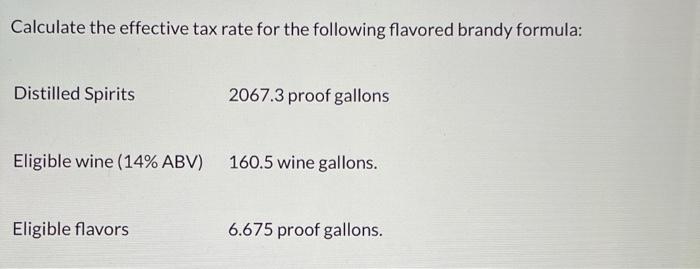

Question: second part is and example problem Calculate the effective tax rate for the following flavored brandy formula: Distilled Spirits 2067.3 proof gallons Eligible wine (14%

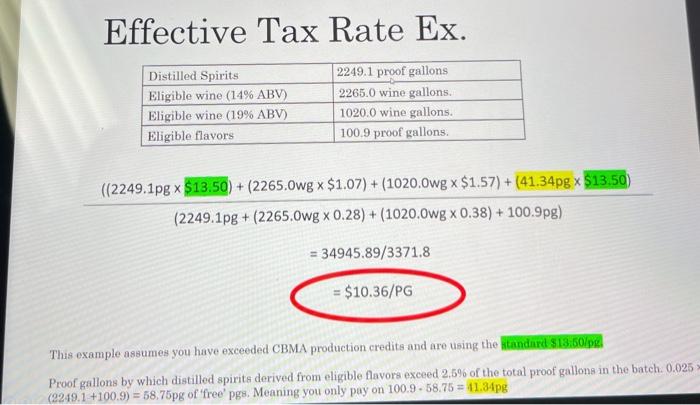

Calculate the effective tax rate for the following flavored brandy formula: Distilled Spirits 2067.3 proof gallons Eligible wine (14\% ABV) 160.5 wine gallons. Eligible flavors 6.675 proof gallons. Effective Tax Rate Ex. (2249.1pg+(2265.0wg0.28)+(1020.0wg0.38)+100.9pg)((2249.1pg$13.50)+(2265.0wg$1.07)+(1020.0wg$1.57)+(41.34pg$13.50)=34945.89/3371.8=$10.36/PG This example assumes you have exceeded CBML production credits and are using the Proof gallons by which distilled spirite derived from eligible flavors exceed 2.596 of the total proof gallons in the bateh. 0.025 (9249.1+100.9)=58.75 pg of 'free' pgs, Meaning you only pay on 100.958.75=41.34pg

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts