Question: Section 1: Consolidation Case Study - Galaxy Ltd and Moon Ltd (Total 70 marks) Galaxy Ltd acquired 80% of the share capital of Moon Lid

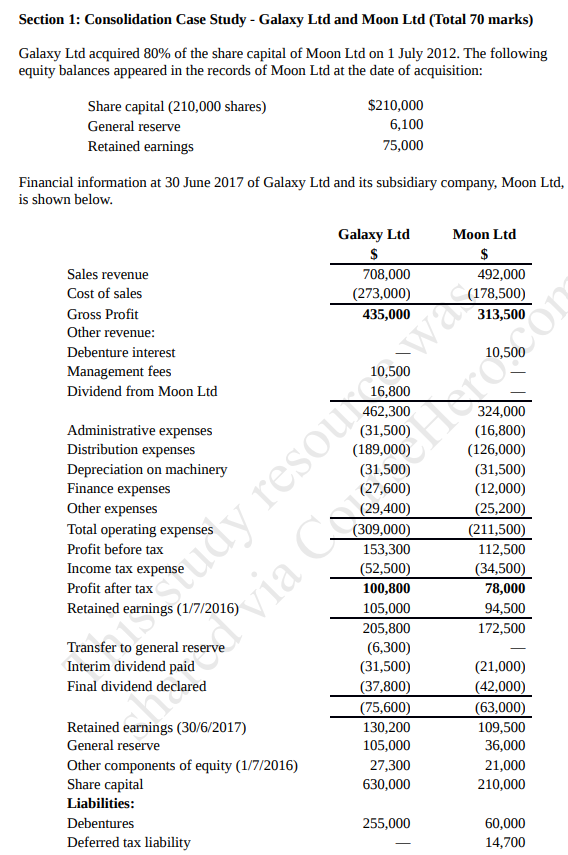

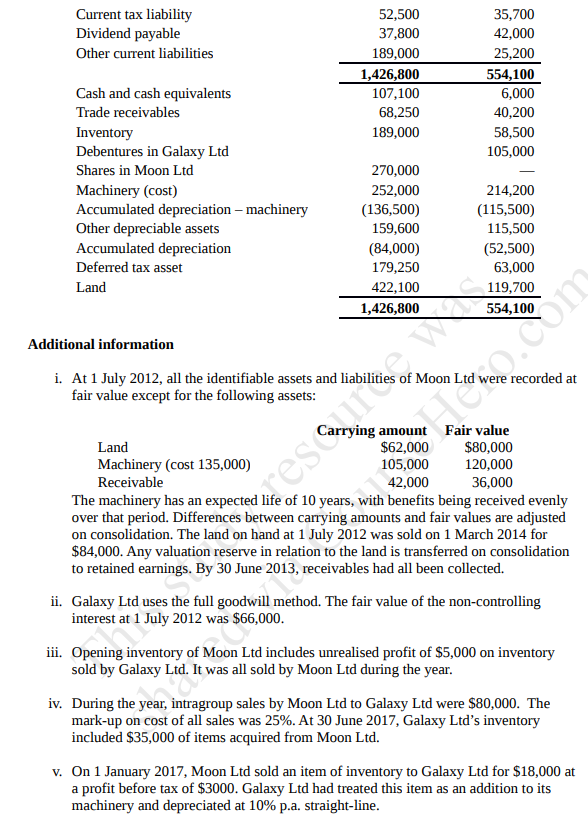

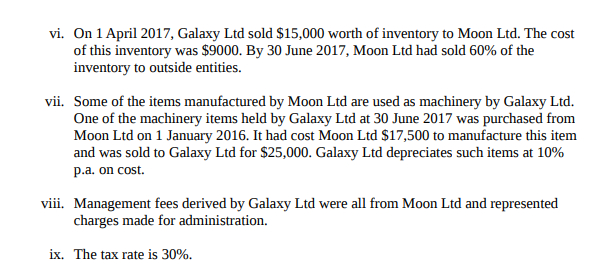

Section 1: Consolidation Case Study - Galaxy Ltd and Moon Ltd (Total 70 marks) Galaxy Ltd acquired 80% of the share capital of Moon Lid on 1 July 2012. The following equity balances appeared in the records of Moon Ltd at the date of acquisition: Share capital (210,000 shares) $210,000 General reserve 6,100 Retained earnings 75,000 Financial information at 30 June 2017 of Galaxy Ltd and its subsidiary company, Moon Ltd, is shown below. Galaxy Ltd Moon Ltd $ $ Sales revenue 708,000 492,000 Cost of sales (273,000) (178,500) Gross Profit 135,000 313,500 Other revenue: Debenture interest 10,500 Management fees 10,500 Dividend from Moon Ltd 16,800 462,300 324,000 Administrative expenses (31,500) (16,800) Distribution expenses (189,000) (126,000) Depreciation on machinery (31,500) (31,500) Finance expenses rudy resou (27,600) (12,000) Other expenses (29,400) (25,200) Total operating expenses (309,000) (211,500) Profit before tax 153,300 112,500 Income tax expense (52,500) (34,500) Profit after tax 100,800 78,000 Retained earnings (1/7/2016) 105,000 94,500 205,800 172,500 Transfer to general reserve (6,300) Interim dividend paid (31,500) (21,000) Final dividend declared (37,800) (42,000) (75,600) 63,000) Retained earnings (30/6/2017) 130,200 109,500 General reserve 105,000 36,000 Other components of equity (1/7/2016) 27,300 21,000 Share capital 630,000 210,000 Liabilities: Debentures 255,000 60,000 Deferred tax liability 14,700Current tax liability 52,500 35,700 Dividend payable 37,000 42,000 Other oirrent liabilities 109,000 25,200 1,420,000 554,100 Cash and cash equivalents 107,100 6,000 Trade receivables 63,250 40,200 Inventory 109,000 50,500 Debentures in Galaxy Ltd 105,000 Shares in Moon Ltd 220,000 Machinery (cost) 252,000 214,200 Accumulated depreciation machinery (136,500) [115,500] Other depreciable assets 159,500 115,500 Accumulated depreciation (04,000] (52,500] Deferred tax asset 120,250 63,000 Land 422,100 119,700 1,426,000 554,100 Additional information i. At 1 July 2012. all the identiable assets and liabilities of Moon Ltd were recorded at fair value except for the following assets: Carrying amount Fair value Land $52,000 $30,000 Machinery [cost 135.000] 105,000 120,000 Receivable 42.000 36,000 The machinery has an expected life of 10 years, with benets being received evenly over that period. Differences between carrying amounts and fair values are adjusted on consolidation. The land on hand at 1 July 2012 was sold on 1 March 2014 for $04,000 Any valuation reserve in relation to the land is transferred on consolidation to retained earnings. By 30 June 2013, receivables had all been collected ii. Galaxy Ltd uses the full goodwill method. The fair value of the non-controlling interest at 1 July 2012 was $55,000. iii. Opening inventory of Moon Ltd includes tutreaiised prot of $5,000 on inventory sold by Galaxy Ltd. It was all sold by Moon Ltd during the year. iv. During the year, intragronp sales by Moon Ltd to Galaxy Ltd were $80,000. The mark-up on cost of all sales was 25%. At 30 June 2012', Galaxy Ltd's inventory included $35,000 of items acquired from Moon Ltd. v. 011 1 January 2017-\viii. 0n 1 April 2017, Galaxy Ltd sold 515,000 worm of inventory to Moon Ltd. The cost of this inventory was $9000. By 30 June 2011', Moon Ltd had said 60% of the inventory to outside entities. Some of the items manufactured by Moon Ltd are used as machinery by Galaxy Ltd. One of the machinery items held by Galaxy Ltd at 30 June 201? was purchased from Moon Ltd on 1 January 2016. It had cost Moon Ltd $17,500 to manufacture this item and was sold to Galaxy Ltd for $25,000. Galaxy Ltd depredates such items at 10% pa. on cost. Management fees derived by Galaxy Ltd were all hum Moon Ltd and represented charges made for administration. The taxl'ate is 30%