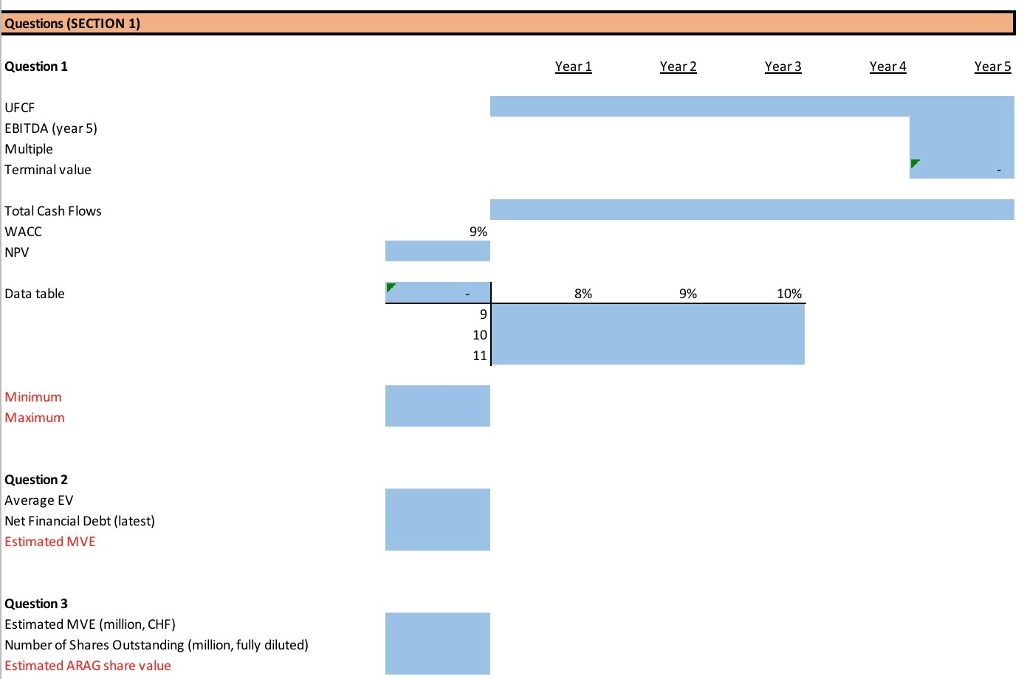

Question: SECTION 1 - DCF ANALYSIS: Question 1A - Using a range of WACC of 8% to 10% and an EBITDA multiple of 9 to 11

SECTION 1 - DCF ANALYSIS:

Question 1A - Using a range of WACC of 8% to 10% and an EBITDA multiple of 9 to 11 times to calculate the terminal value, please establish a valuation range (EV) for ARAG. Enter the min value with the format: "000.0"

Question 1B - Enter the max value with the format: "123.4"

Question 2 - Based on the mid-point (average value) of your valuation range, please derive the market value of equity for ARAG without decimal e.g. "123"

Question 3 - Based on the estimated market value of equity (as per question 2), please derive the value per ARAG share e.g. "12.3"

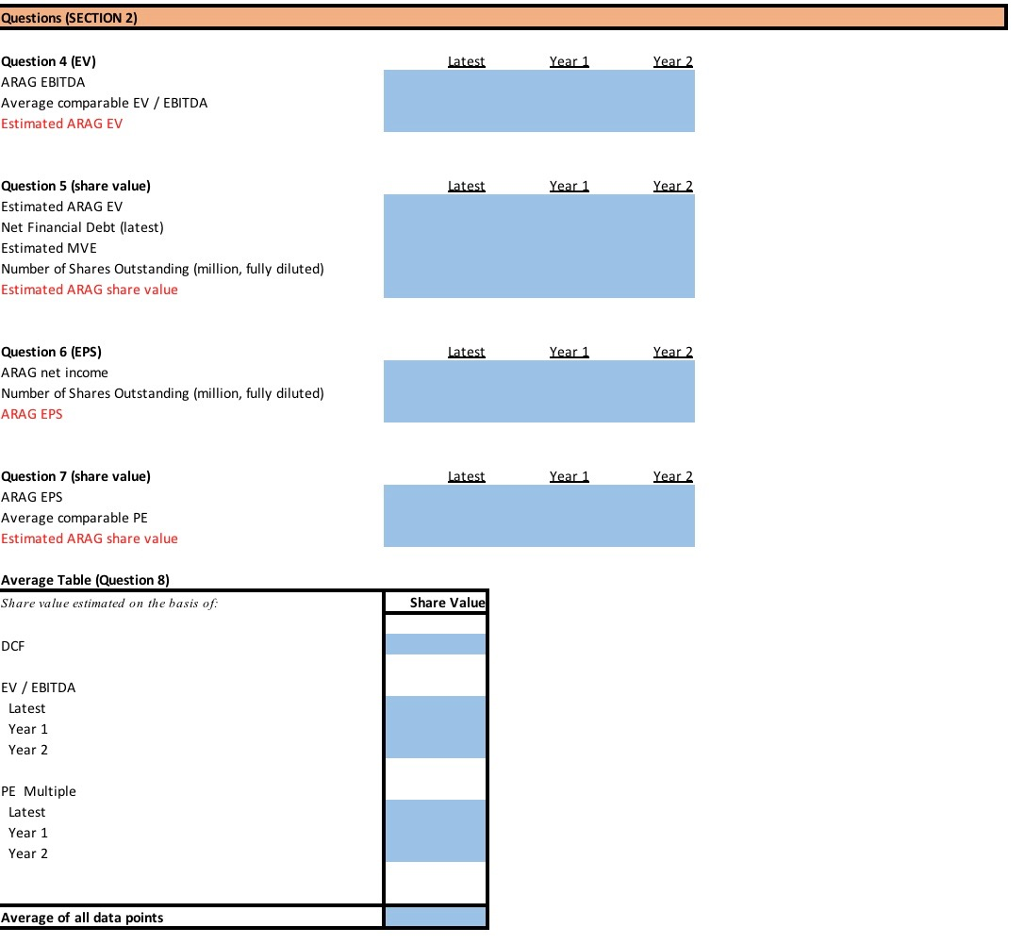

SECTION 2 - COMPARABLE MULTIPLES ANALYSIS:

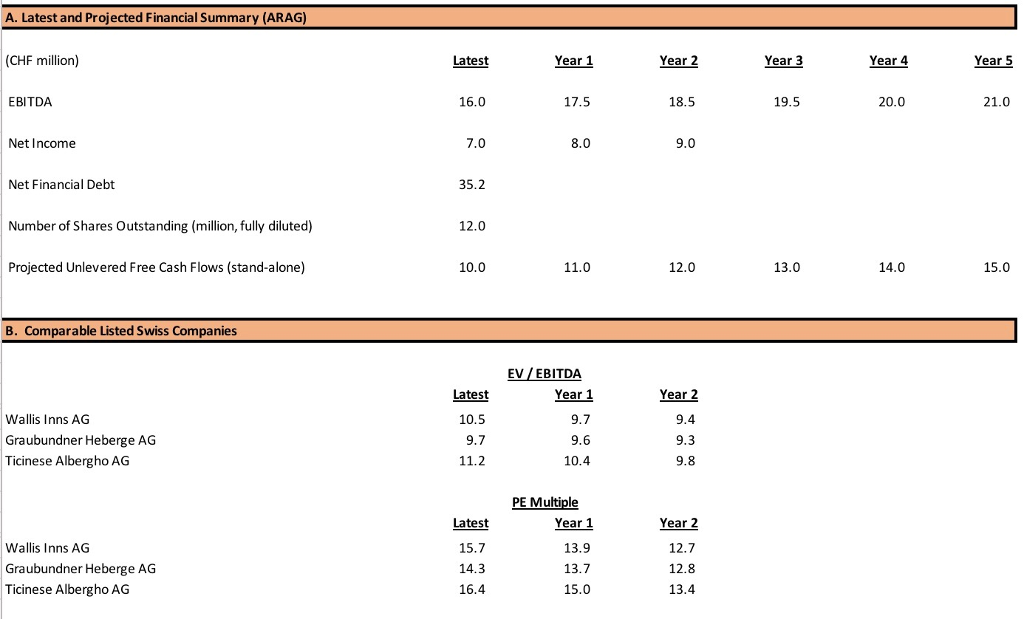

Question 4 - Based on the average EBITDA multiples of the comparable universe for each of the latest and projected (Year 1 an Year 2) EBITDA, please calculate the estimated EV for the 3 years. Below, enter the answer for year 2, with one decimal e.g. "123.4".

Question 5 - For each of the data calculated in question 4, please derive the estimated value per ARAG share. Below, enter the value for year 1, with one decimal e.g. "12.3".

Question 6 - Calculate the EPS for ARAG over the 3 latest and projected (Year 1 and Year 2) periods. Below, entre the result for year 1 with 2 decimals; e.g. "1.23"

Question 7 - Based on the average PE multiples of the comparable universe for each of the latest and projected (Year 1 and Year 2) EPS, please calculate the estimated value per ARAG share. Below, enter the value for year 2, with one decimal e.g. "1.2".

SECTION 3 CONCLUSIONS:

Question 8 - Fill in the supplied table with the data gathered above. What is the average of all points? (one decimal e.g. "12.3")

Question 9 - Write your conclusions as to the ARAG valuation and your views on the appropriate offer price.

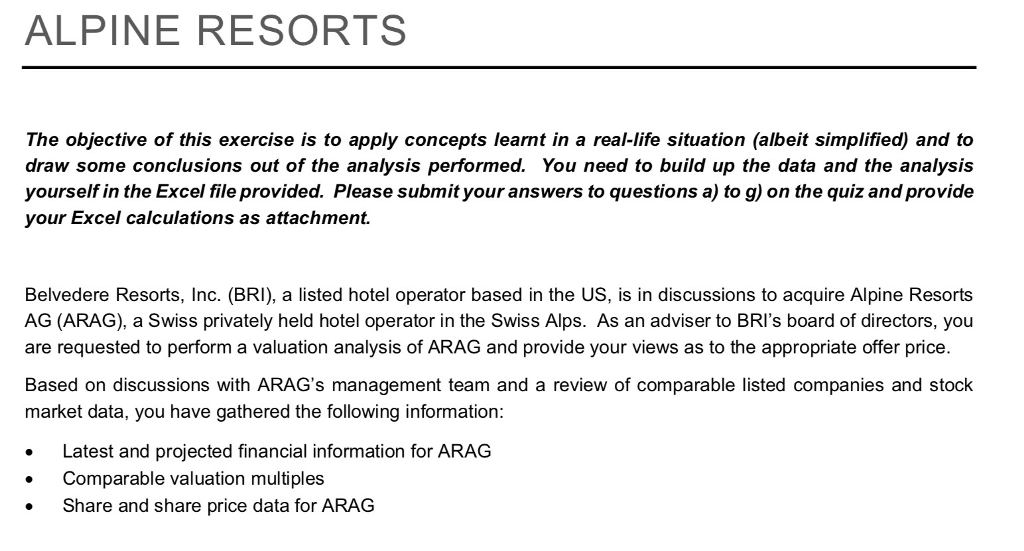

ALPINE RESORTS The objective of this exercise is to apply concepts learnt in a real-life situation (albeit simplified) and to draw some conclusions out of the analysis performed. You need to build up the data and the analysis yourself in the Excel file provided. Please submit your answers to questions a) to g) on the quiz and provide your Excel calculations as attachment. Belvedere Resorts, Inc. (BRI), a listed hotel operator based in the US, is in discussions to acquire Alpine Resorts AG (ARAG), a Swiss privately held hotel operator in the Swiss Alps. As an adviser to BRI's board of directors, you are requested to perform a valuation analysis of ARAG and provide your views as to the appropriate offer price. Based on discussions with ARAG's management team and a review of comparable listed companies and stock market data, you have gathered the following information . Latest and projected financial information for ARAG Comparable valuation multiples Share and share price data for ARAG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts