Question: Section 3 - Cash and Internal Controls (25 marks) Part A-Petty Cash (5 marks) The following Petty Cash transactions took place at Artemis Marketing during

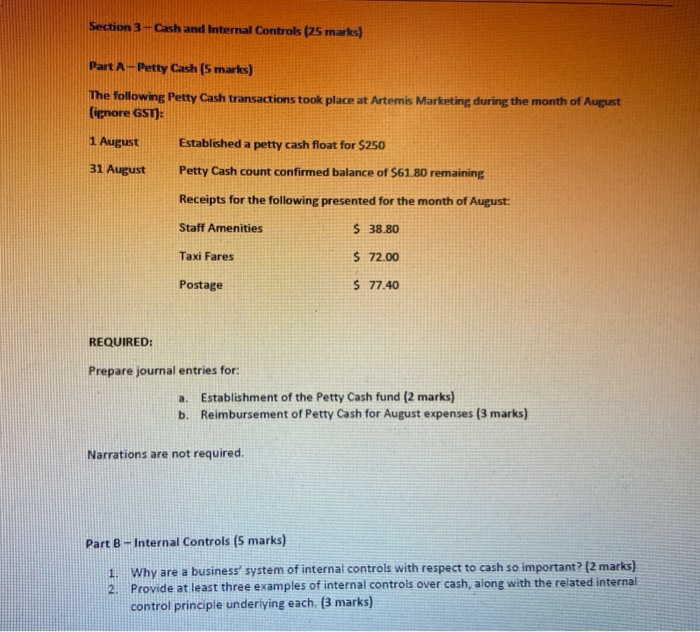

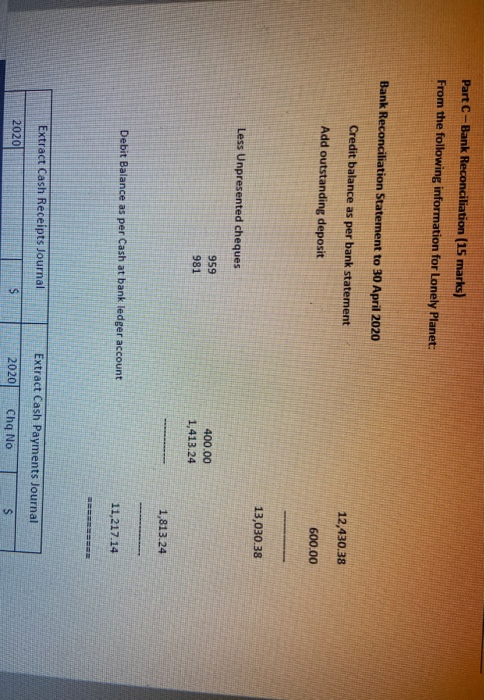

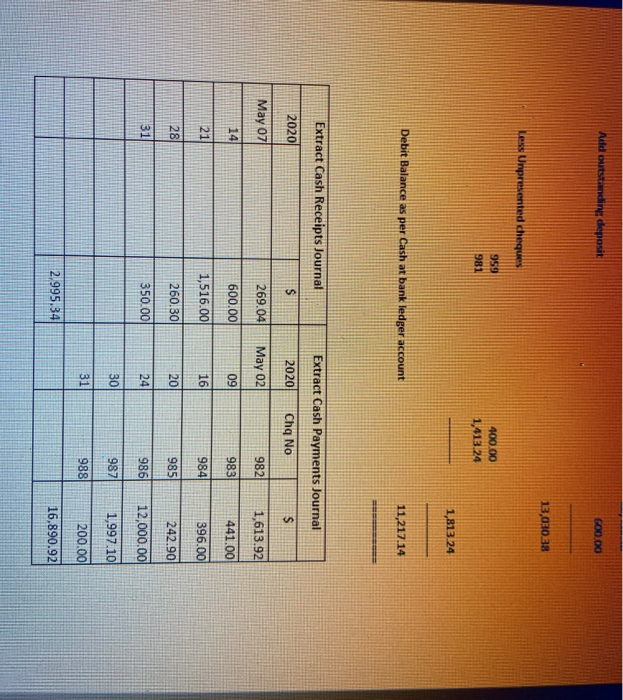

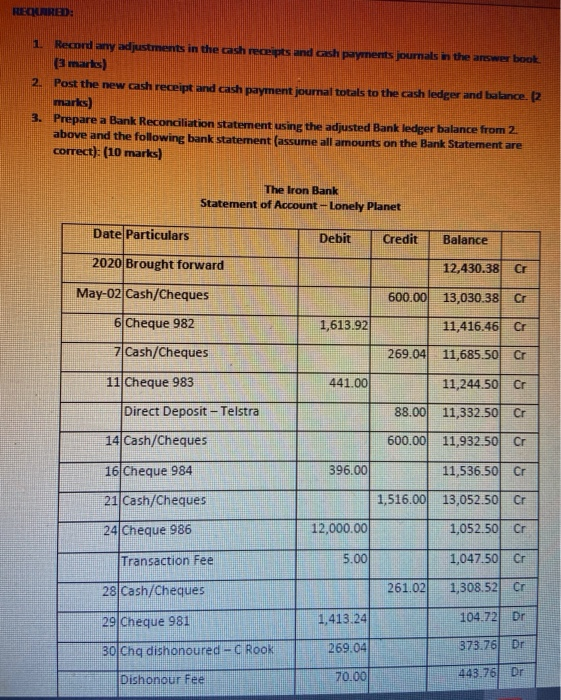

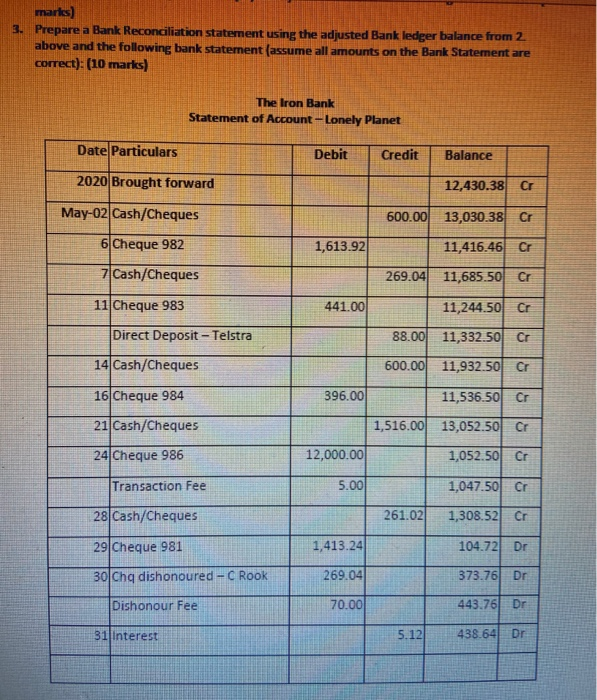

Section 3 - Cash and Internal Controls (25 marks) Part A-Petty Cash (5 marks) The following Petty Cash transactions took place at Artemis Marketing during the month of August (ignore GST): 1 August Established a petty cash float for $250 31 August Petty Cash count confirmed balance of $61.80 remaining Receipts for the following presented for the month of August: Staff Amenities $ 38.80 Taxi Fares $ 72.00 Postage $ 77.40 REQUIRED: Prepare journal entries for: a. Establishment of the Petty Cash fund (2 marks) b. Reimbursement of Petty Cash for August expenses (3 marks) Narrations are not required. Part B - Internal Controls (5 marks) 1. Why are a business' system of internal controls with respect to cash so important? (2 marks) 2. Provide at least three examples of internal controls over cash, along with the related internal control principle underlying each. [3 marks) Part C-Bank Reconciliation (15 marks) From the following information for Lonely Planet: Bank Reconciliation Statement to 30 April 2020 Credit balance as per bank statement 12,430.38 Add outstanding deposit 600.00 13,030.38 Less Unpresented cheques 959 981 400.00 1,413.24 1,813.24 Debit Balance as per Cash at bank ledger account 11,217.14 Extract Cash Receipts Journal Extract Cash Payments Journal 2020 S 2020 Cha No S Add outstanding deposit 600.00 13,030.38 Less Unpresented cheques 959 981 400.00 1,413.24 1,813.24 Debit Balance as per Cash at bank ledger account 11,217.14 Extract Cash Receipts Journal Extract Cash Payments Journal 2020 s 2020 Chq No $ May 07 269.04 May 02 982 1,613.92 14 600.00 09 983 441.00 21 1,516.00 16 984 396.00 28 260.30 20 985 242.90 31 350.00 24 986) 12,000.00 30 987 1,997.10 31 988 200.00 2.995.34 16.890.92 REQUIRED: 1. Record any adjustments in the cash receipts and cash payments journals in the answer book 2. Post the new cash receipt and cash payment journal totals to the cash ledger and balance. (2 marks) 3. Prepare a Bank Reconciliation statement using the adjusted Bank ledger balance from 2 above and the following bank statement (assume all amounts on the Bank Statement are correct): (10 marks) The Iron Bank Statement of Account - Lonely Planet Date Particulars Debit Credit Balance 2020 Brought forward 12,430.38 Cr May-02 Cash/Cheques 600.00 13,030.38 Cr 6 Cheque 982 1,613.92 11,416.46 Cr 7 Cash/Cheques 269.04 11,685.50 Cr 11 Cheque 983 441.00 11,244.50 Cr Direct Deposit - Telstra 88.00 11,332.50 Cr 14 Cash/Cheques 600.00 11,932.50 Cr 16 Cheque 984 396.00 11,536.50 Cr 21 Cash/Cheques 1,516.00 13,052.50 Cr 24 Cheque 986 12,000.00 1,052.50Cr Transaction Fee 5.00 1,047.50 Cr 28 Cash/Cheques 261.02 1,308.52 Cr 29 Cheque 981 1,413.24 104.72 Dr 269.04 30 Cha dishonoured - Rook 373.76 Dr 70.00 Dishonour Fee 443.761 Dr marks) 3. Prepare a Bank Reconciliation statement using the adjusted Bank ledger balance from 2 above and the following bank statement (assume all amounts on the Bank Statement are correct): (10 marks) The Iron Bank Statement of Account - Lonely Planet Date Particulars Debit Credit Balance 2020 Brought forward 12,430.38 Cr May-02 Cash/Cheques 600.00 13,030.38 Cr 6 Cheque 982 1,613.92 11,416.46 Cr 7 Cash/Cheques 269.04 11,685.50 Cr 11 Cheque 983 441.00 11,244.50 Cr Direct Deposit - Telstra 88.00 11,332.50 Cr 14 Cash/Cheques 600.00 11,932.50 Cr 16 Cheque 984 396.00 11,536.50l Cr 21 Cash/Cheques 1,516.00 13,052.50 Cr 24 Cheque 986 12,000.00 1,052.50 Cr Transaction Fee 5.00 1,047.50 Cr 28 Cash/Cheques 261.02 1,308.52 Cr 29 Cheque 981 1,413.24 104.72 Dr 30 Cha dishonoured - Rook 269.04 373.76 Dr Dishonour Fee 70.00 443.76 Dr 31 interest 5.12 438.64 Dr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts