Question: Section 3. Ratio Trend Analysis Using the ratio analysis, identify the trends in ratios between the last two years as well as compare to the

- Section 3. Ratio Trend Analysis

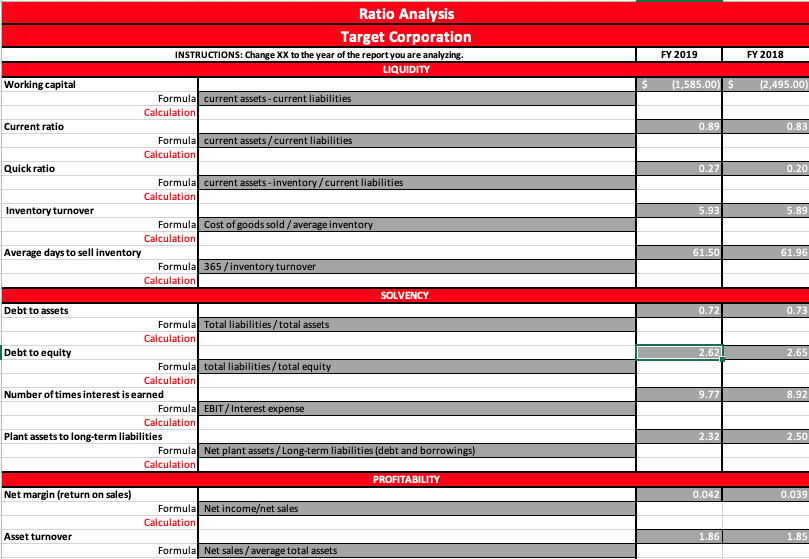

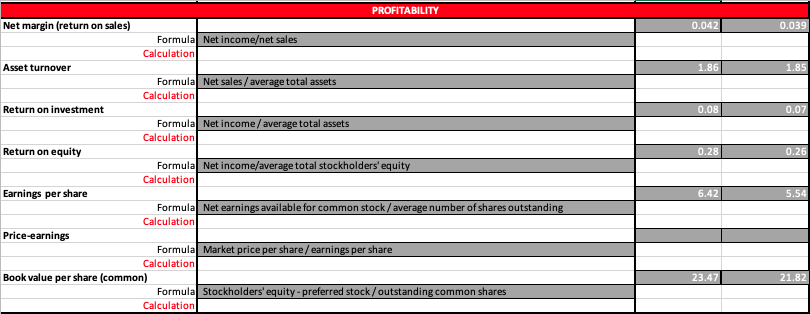

- Using the ratio analysis, identify the trends in ratios between the last two years as well as compare to the industry information accessed from the IBIS database.

- Also analyze ratios and figures based on the disclosures in the annual report as evidence to the noticeable trends

FY 2019 FY 2018 (1,585.00 $ (2,495.00 0.89 0.83 0.27 0.20 5.93 5.89 61.50 61.96 Ratio Analysis Target Corporation INSTRUCTIONS:Change XX to the year of the report you are analyzing. LIQUIDITY Working capital Formula current assets -current liabilities Calculation Current ratio Formula current assets/ current liabilities Calculation Quick ratio Formula current assets - inventory/current liabilities Calculation Inventory turnover Formula Cost of goods sold / average inventory Calculation Average days to sell inventory Formula 365 / inventory turnover Calculation SOLVENCY Debt to assets Formula Total liabilities/total assets Calculation Debt to equity Formula total liabilities/total equity Calculation Number of times interest is earned Formula EBIT/Interest expense Calculation Plant assets to long-term liabilities Formula Net plant assets / Long-term liabilities (debt and borrowings) Calculation PROFITABILITY Net margin (return on sales) Formula Net incomeet sales Calculation Asset turnover Formula Net sales / average total assets 0.72 0.73 2.621 2.65 9.77 8.92 2.32 2.50 0.042 0.039 1.86 1.85 0.042 0.039 1.86 1.85 0.08 0.07 0.28 0.26 PROFITABILITY Net margin (return on sales) Formula Net incomeet sales Calculation Asset turnover Formula Net sales / average total assets Calculation Return on investment Formula Net income/average total assets Calculation Return on equity Formula Net income/average total stockholders' equity Calculation Earnings per share Formula Net earnings available for common stock/ average number of shares outstanding Calculation Price-earnings Formula Market price per share/ earnings per share Calculation Book value per share (common) Formula Stockholders' equity-preferred stock/outstanding common shares Calculation 6.42 5.54 23.47 21.82 FY 2019 FY 2018 (1,585.00 $ (2,495.00 0.89 0.83 0.27 0.20 5.93 5.89 61.50 61.96 Ratio Analysis Target Corporation INSTRUCTIONS:Change XX to the year of the report you are analyzing. LIQUIDITY Working capital Formula current assets -current liabilities Calculation Current ratio Formula current assets/ current liabilities Calculation Quick ratio Formula current assets - inventory/current liabilities Calculation Inventory turnover Formula Cost of goods sold / average inventory Calculation Average days to sell inventory Formula 365 / inventory turnover Calculation SOLVENCY Debt to assets Formula Total liabilities/total assets Calculation Debt to equity Formula total liabilities/total equity Calculation Number of times interest is earned Formula EBIT/Interest expense Calculation Plant assets to long-term liabilities Formula Net plant assets / Long-term liabilities (debt and borrowings) Calculation PROFITABILITY Net margin (return on sales) Formula Net incomeet sales Calculation Asset turnover Formula Net sales / average total assets 0.72 0.73 2.621 2.65 9.77 8.92 2.32 2.50 0.042 0.039 1.86 1.85 0.042 0.039 1.86 1.85 0.08 0.07 0.28 0.26 PROFITABILITY Net margin (return on sales) Formula Net incomeet sales Calculation Asset turnover Formula Net sales / average total assets Calculation Return on investment Formula Net income/average total assets Calculation Return on equity Formula Net income/average total stockholders' equity Calculation Earnings per share Formula Net earnings available for common stock/ average number of shares outstanding Calculation Price-earnings Formula Market price per share/ earnings per share Calculation Book value per share (common) Formula Stockholders' equity-preferred stock/outstanding common shares Calculation 6.42 5.54 23.47 21.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts