Question: Section 6-INVENTORY COSTING USING THE LIFO METHOD All companies are on a calendar year unless otherwise stated 1. CorpCo uses the periodic method and LIFO

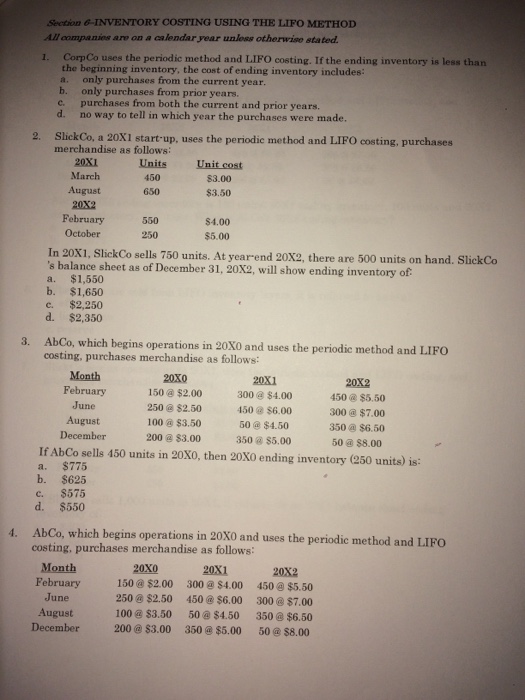

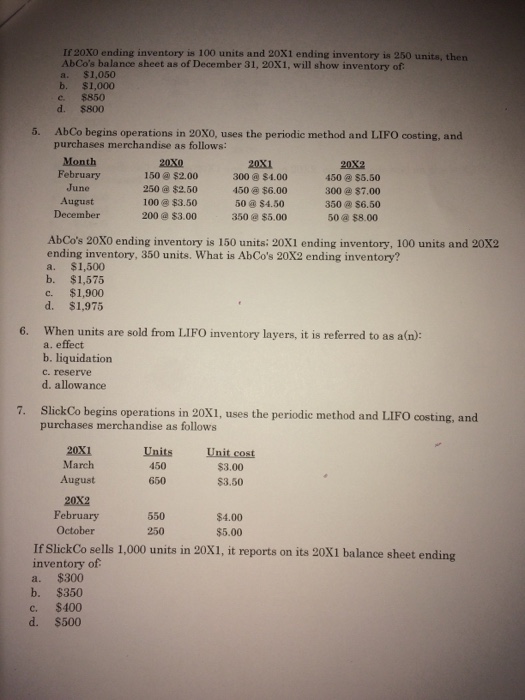

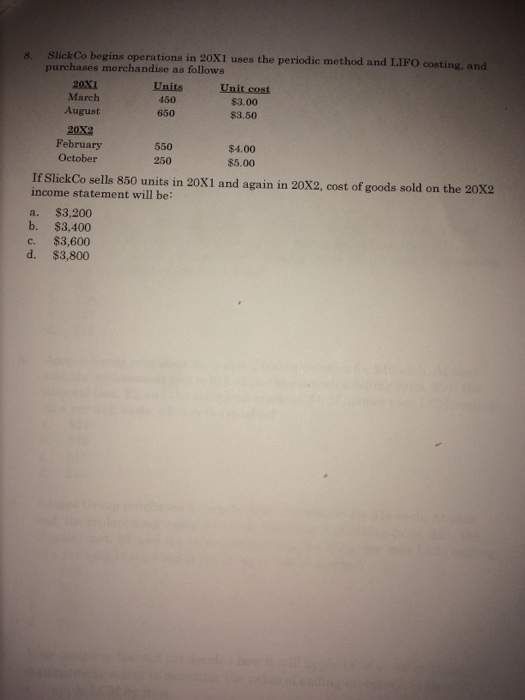

Section 6-INVENTORY COSTING USING THE LIFO METHOD All companies are on a calendar year unless otherwise stated 1. CorpCo uses the periodic method and LIFO costing. If the ending inventory is less than the beginning inventory, the cost of ending inventory includes: a. only purchases from the current year b. only purchases from prior years. c. purchases from both the current and prior years. d. no way to tell in which year the purchases were made. 2. SlickCo, a 20X1 start-up, uses the periodie method and LIFO costing, purchases merchandise as follows 20X1 March August Units 450 650 Unit cost $3.00 $3.50 February October 550 250 $4.00 $5.00 In 20X1, SlickCo s balance sheet as of December 31, 20X2, will show ending inventory of sells 750 units. At year end 20X2, there are 500 units on hand. SlickCo a. $1,550 b. $1,650 c. $2,250 d. $2,350 3. AbCo, which begins operations in 20X0 and uses the periodic method and LIFO costing, purchases merchandise as follows: Month Februar 20x0 150@ $2.00 250 $2.50 100 $3.50 200 $3.00 20x1 300 @ $4.00 450@ $6.00 50@$4.50 350@ $5.00 20x2 450@ $5.50 300a $7.00 350@ $6.50 50 a $8.00 August If AbCo sells 450 units in 20XO, then 20X0 ending inventory (250 units) is: a. $775 b. $625 c. $575 d. $550 AbCo, which begins operations in 20X0 and uses the periodic method and LIFO costing, purchases merchandise as follows: 4. Month February 20X0 150@ $2.00 20x2 300 $4.00 450 $5.50 250 @ $2.50 450$6.00 300@$7.00 100 $3.50 50$4.50 350$6.50 December 200 $3.00 350 @ $5.00 50 @ $8.00 August

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts