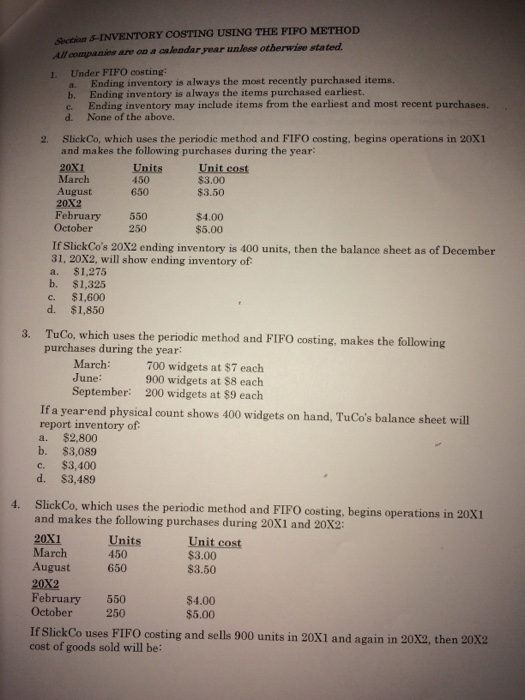

Question: Seetion &INVENTORY COSTING USING THE FIFO METHOD All companies are on a calendar year unless otherwise stated I. Under FIFO costing: a. Ending inventory is

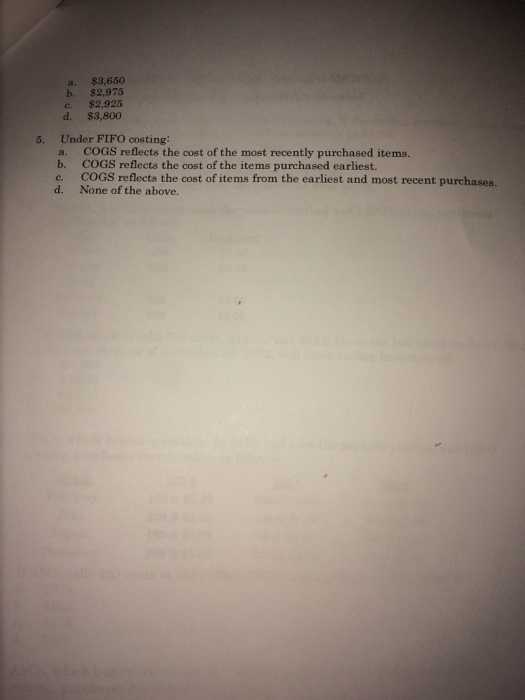

Seetion &INVENTORY COSTING USING THE FIFO METHOD All companies are on a calendar year unless otherwise stated I. Under FIFO costing: a. Ending inventory is always the most recently purchased items. b. Ending inventory is always the items purchased earliest. c. Ending inventory may include items from the earliest and most recent purchases. d. None of the above. SlickCo, which uses the periodic method and FIFO costing, begins operations in 20X1 and makes the following purchases during the year: 20X1 March August 20x2 February 550 October 2. Units 450 650 Unit cost $3.00 $3.50 $4.00 $5.00 250 If SlickCo's 20X2 ending inventory is 400 units, then the balance sheet as of December 31, 20x2, will show ending inventory of a. $1,275 b. $1,325 c. $1,600 d. $1,850 TuCo, which uses the periodic method and FIFO costing, makes the following purchases during the year: 3. March 700 widgets at $7 each June: 900 widgets at $8 each 200 widgets at $9 each September: If a year-end physical count shows 400 widgets on hand, TuCo's balance sheet will report inventory of a. $2,800 b. $3,089 c. $3,400 d. $3,489 SlickCo, which uses the periodic method and FIFO costing, begins operations in 20X1 and makes the following purchases during 20X1 and 20x2: 4. 20x1 March August 650 20X2 February 550 October 250 Units 450 Unit cost $3.00 $3.50 $4.00 $5.00 If SlickCo uses FIFO costing and sells 900 units in 20X1 and again in 20x2, then 20x2 cost of goods sold will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts