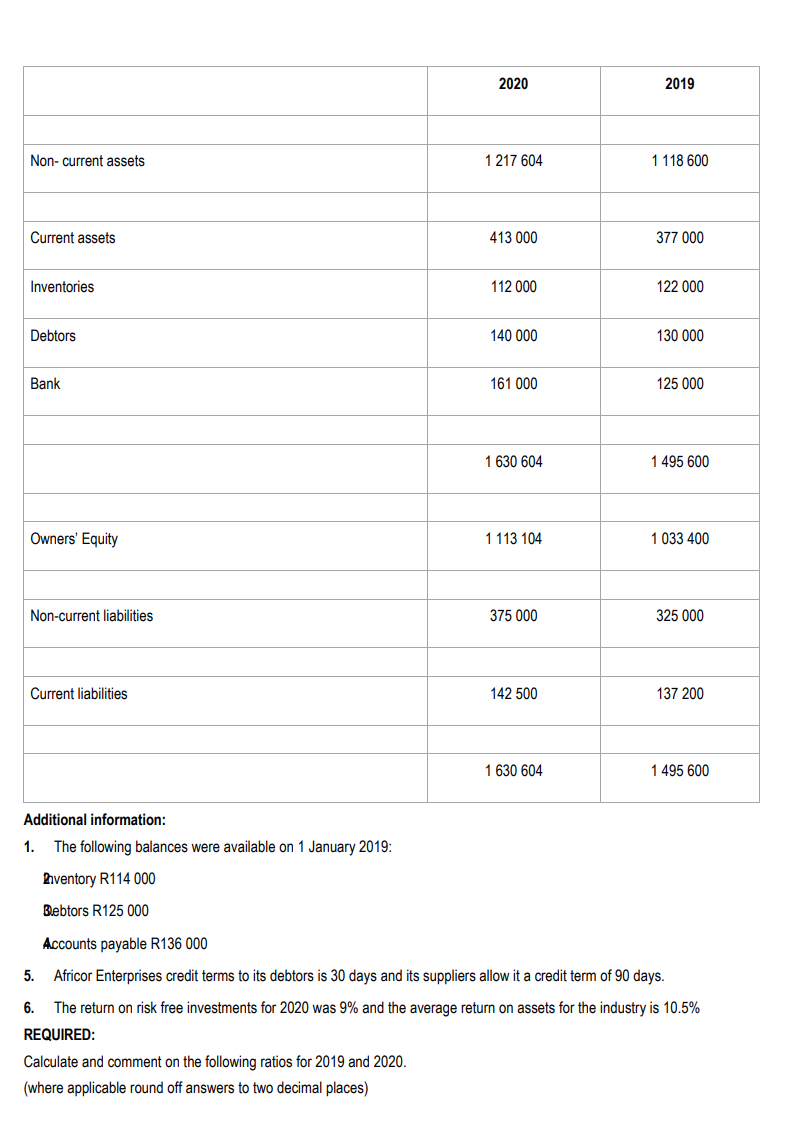

Question: SECTION A [30 MARKS] Answer ALL the questions in this section. 1 (30 Marks) The following information is provided for Africor Enterprises: Statement of Comprehensive

![SECTION A [30 MARKS] Answer ALL the questions in this section.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670120fcc893f_228670120fc3dc87.jpg)

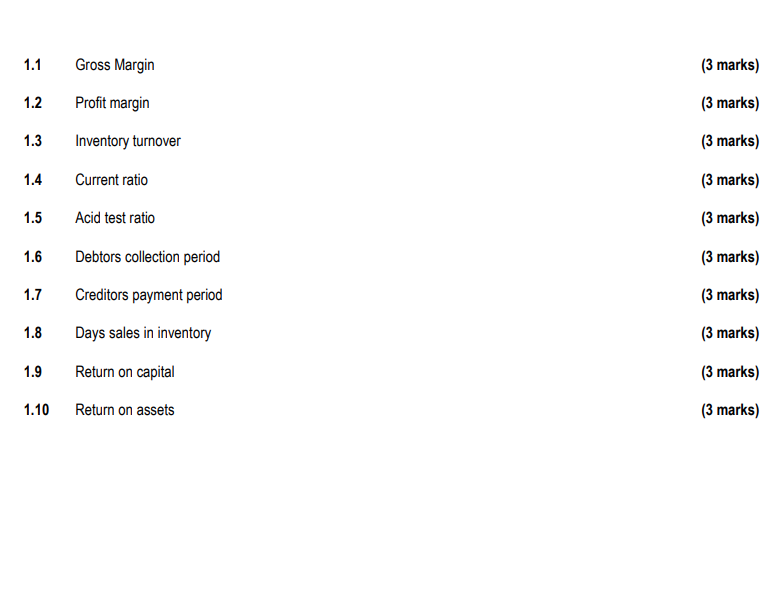

SECTION A [30 MARKS] Answer ALL the questions in this section. 1 (30 Marks) The following information is provided for Africor Enterprises: Statement of Comprehensive Income for the year ended 31 December 2020 2020 2019 Sales (90% credit) 812 000 725 000 Cost of sales (all on credit) (446 600) (362 500) Gross profit 365 400 362 500 Operating expenses (182 700) (145 000) Operating profit 182 700 217 500 Interest expense (72 000) (60 000) Profit before tax 110 700 157 500 taxation (30 996) (44 100) Profit after tax 79 704 113 400 Statement of Financial Position as at 31 December 2020 2020 2019 Non-current assets 1 217 604 1118 600 Current assets 413 000 377 000 Inventories 112 000 122 000 Debtors 140 000 130 000 Bank 161 000 125 000 1 630 604 1 495 600 Owners' Equity 1 113 104 1 033 400 Non-current liabilities 375 000 325 000 Current liabilities 142 500 137 200 1 630 604 1 495 600 Additional information: 1. The following balances were available on 1 January 2019: Riventory R114 000 Bebtors R125 000 5. Accounts payable R136 000 Africor Enterprises credit terms to its debtors is 30 days and its suppliers allow it a credit term of 90 days. 6. The return on risk free investments for 2020 was 9% and the average return on assets for the industry is 10.5% REQUIRED: Calculate and comment on the following ratios for 2019 and 2020. (where applicable round off answers to two decimal places) 1.1 Gross Margin (3 marks) 1.2 Profit margin (3 marks) 1.3 Inventory turnover (3 marks) 1.4 Current ratio (3 marks) 1.5 Acid test ratio (3 marks) 1.6 (3 marks) Debtors collection period Creditors payment period 1.7 (3 marks) 1.8 (3 marks) Days sales in inventory Return on capital 1.9 (3 marks) 1.10 Return on assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts