Question: SECTION A (40 marks) This ONE (1) question is compulsory and must be attempted. Question 1 Li Ning Sport Inc's income statement (shown in thousands

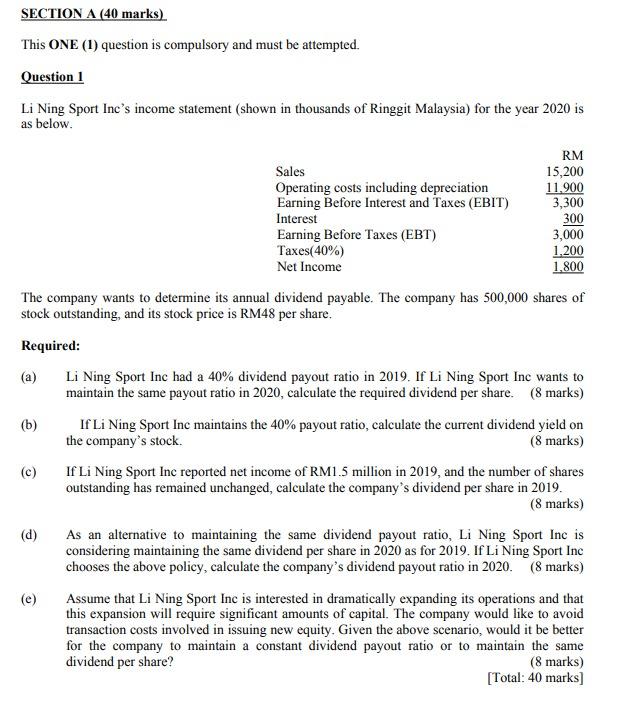

SECTION A (40 marks) This ONE (1) question is compulsory and must be attempted. Question 1 Li Ning Sport Inc's income statement (shown in thousands of Ringgit Malaysia) for the year 2020 is as below. RM Sales 15,200 Operating costs including depreciation 11.900 Earning Before Interest and Taxes (EBIT) 3,300 Interest 300 Earning Before Taxes (EBT) 3,000 Taxes(40%) 1,200 Net Income 1,800 The company wants to determine its annual dividend payable. The company has 500,000 shares of stock outstanding, and its stock price is RM48 per share. Required: (a) Li Ning Sport Inc had a 40% dividend payout ratio in 2019. If Li Ning Sport Inc wants to maintain the same payout ratio in 2020, calculate the required dividend per share. (8 marks) (b) If Li Ning Sport Inc maintains the 40% payout ratio, calculate the current dividend yield on the company's stock. (8 marks) (c) If Li Ning Sport Inc reported net income of RM1.5 million in 2019, and the number of shares outstanding has remained unchanged, calculate the company's dividend per share in 2019. (8 marks) (d) As an alternative to maintaining the same dividend payout ratio, Li Ning Sport Inc is considering maintaining the same dividend per share in 2020 as for 2019. If Li Ning Sport Inc chooses the above policy, calculate the company's dividend payout ratio in 2020. (8 marks) (e) Assume that Li Ning Sport Inc is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transaction costs involved in issuing new equity. Given the above scenario, would it be better for the company to maintain a constant dividend payout ratio or to maintain the same dividend per share? (8 marks) [Total: 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts