Question: SECTION A ANSWER ALL QUESTIONS (1-a, 1-b and 2) IN SECTION A. This section is worth 25 marks QUESTION 1-A Roger Small has always been

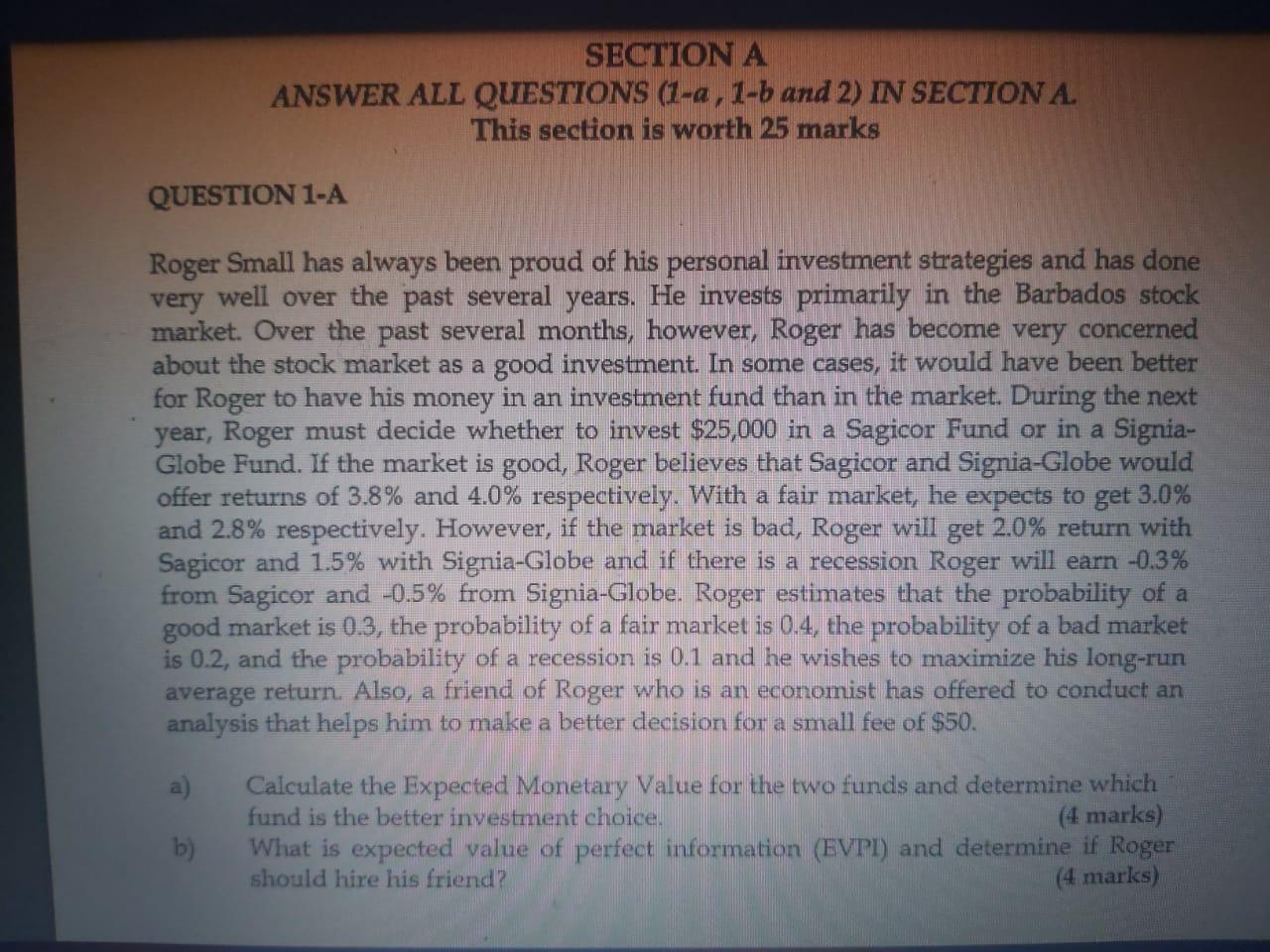

SECTION A ANSWER ALL QUESTIONS (1-a, 1-b and 2) IN SECTION A. This section is worth 25 marks QUESTION 1-A Roger Small has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the Barbados stock market. Over the past several months, however, Roger has become very concerned about the stock market as a good investment. In some cases, it would have been better for Roger to have his money in an investment fund than in the market. During the next year, Roger must decide whether to invest $25,000 in a Sagicor Fund or in a Signia- Globe Fund. If the market is good, Roger believes that Sagicor and Signia-Globe would offer returns of 3.8% and 4.0% respectively. With a fair market, he expects to get 3.0% and 2.8% respectively. However, if the market is bad, Roger will get 2.0% return with Sagicor and 1.5% with Signia-Globe and if there is a recession Roger will earn -0.3% from Sagicor and -0.5% from Signia-Globe. Roger estimates that the probability of a good market is 0.3, the probability of a fair market is 0.4, the probability of a bad market is 0.2, and the probability of a recession is 0.1 and he wishes to maximize his long-run average return. Also, a friend of Roger who is an economist has offered to conduct an analysis that helps him to make a better decision for a small fee of $50. a) b) Calculate the Expected Monetary Value for the two funds and determine which fund is the better investment choice. (4 marks) What is expected value of perfect information (EVPI) and determine if Roger should hire his friend? (4 marks) SECTION A ANSWER ALL QUESTIONS (1-a, 1-b and 2) IN SECTION A. This section is worth 25 marks QUESTION 1-A Roger Small has always been proud of his personal investment strategies and has done very well over the past several years. He invests primarily in the Barbados stock market. Over the past several months, however, Roger has become very concerned about the stock market as a good investment. In some cases, it would have been better for Roger to have his money in an investment fund than in the market. During the next year, Roger must decide whether to invest $25,000 in a Sagicor Fund or in a Signia- Globe Fund. If the market is good, Roger believes that Sagicor and Signia-Globe would offer returns of 3.8% and 4.0% respectively. With a fair market, he expects to get 3.0% and 2.8% respectively. However, if the market is bad, Roger will get 2.0% return with Sagicor and 1.5% with Signia-Globe and if there is a recession Roger will earn -0.3% from Sagicor and -0.5% from Signia-Globe. Roger estimates that the probability of a good market is 0.3, the probability of a fair market is 0.4, the probability of a bad market is 0.2, and the probability of a recession is 0.1 and he wishes to maximize his long-run average return. Also, a friend of Roger who is an economist has offered to conduct an analysis that helps him to make a better decision for a small fee of $50. a) b) Calculate the Expected Monetary Value for the two funds and determine which fund is the better investment choice. (4 marks) What is expected value of perfect information (EVPI) and determine if Roger should hire his friend? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts