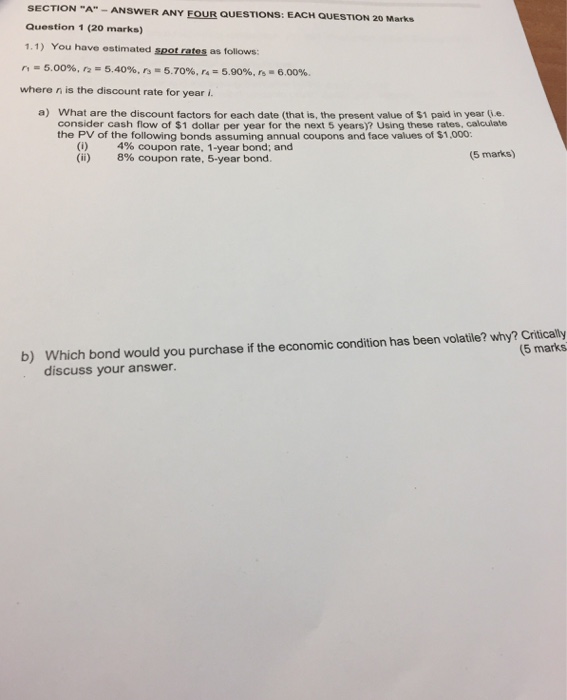

Question: SECTION A- ANSWER ANY EOUR QUESTIONS: EACH QUESTION 20 Marks Question 1 (20 marks) 1.1) You have estimated spot rates as follows r,-5.00%, = 5.40%,

SECTION A"- ANSWER ANY EOUR QUESTIONS: EACH QUESTION 20 Marks Question 1 (20 marks) 1.1) You have estimated spot rates as follows r,-5.00%, = 5.40%, n . 5.7096, ra = 5.90%, rs _ 6.00%. where n is the discount rate for year i. a) What are the discount factors for each date (that is, the present value of $1 paid in year (i.e. consider cash flow of $1 dollar per year for the next 5 years)? Using these rates, calculate the PV of the following bonds assuming annual coupons and face values of $1,000: (i) (ii) 4% coupon rate, 1-year bond; and 8% coupon rate, 5-year bond. 5 marks) Which bond would you purchase if the economic condition has been volatile? why? Critically discuss your answer. 5 marks b)

Step by Step Solution

There are 3 Steps involved in it

Question 1 Given Data Spot rates r1 500 r2 540 r3 570 r4 590 r5 600 Part a Calculate Discount Factors Formula for discount factor for year i DFi frac11 rii Calculations Year Spot Rate Discount Factor ... View full answer

Get step-by-step solutions from verified subject matter experts