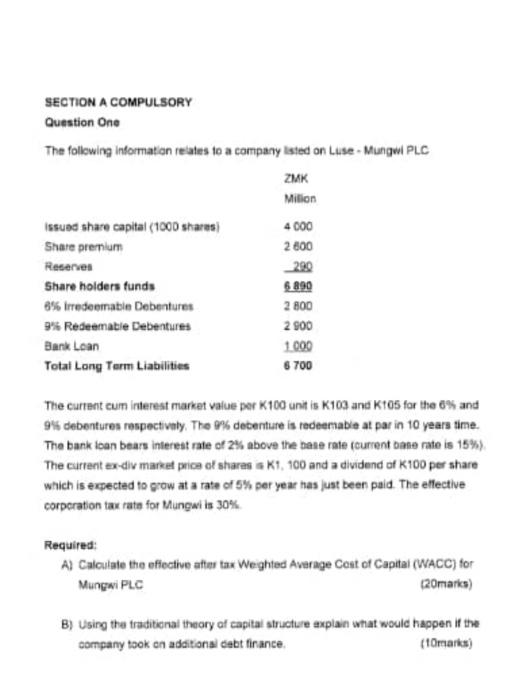

Question: SECTION A COMPULSORY Question One The following information reiates to a company Isted on Luse - Mungwi PLC The current cum interest market value per

SECTION A COMPULSORY Question One The following information reiates to a company Isted on Luse - Mungwi PLC The current cum interest market value per K100 unit is K103 and Kt05 for the 6N and 9 Se debentures respectivaly. The 9% deterture is redeemable at par in 10 years time. The bank ioan bears interest rate of 2% above the base rate fcurcent base rate is 15% ). The current ex-div market price of shares s K1,100 and a dividend of K100 per share which is expected to grow at a rate of 5% per year has just been paid. The eflective corpcration tax rate for Mungwi is 30%. Required: A) Calculale the effective after tax Weghted Avarage Cost of Capitai (WACC) for Mungwi PLC (20marks) B) Using the traditicnal theory of capital structure axplain what woulc happen if the company took on additonai debt finance. (toraarks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts