Question: SECTION A This question is compulsory Question 1: Financial Statement Analysis Cyclorama Ltd is a retailer. It buys goods and then sells them on. The

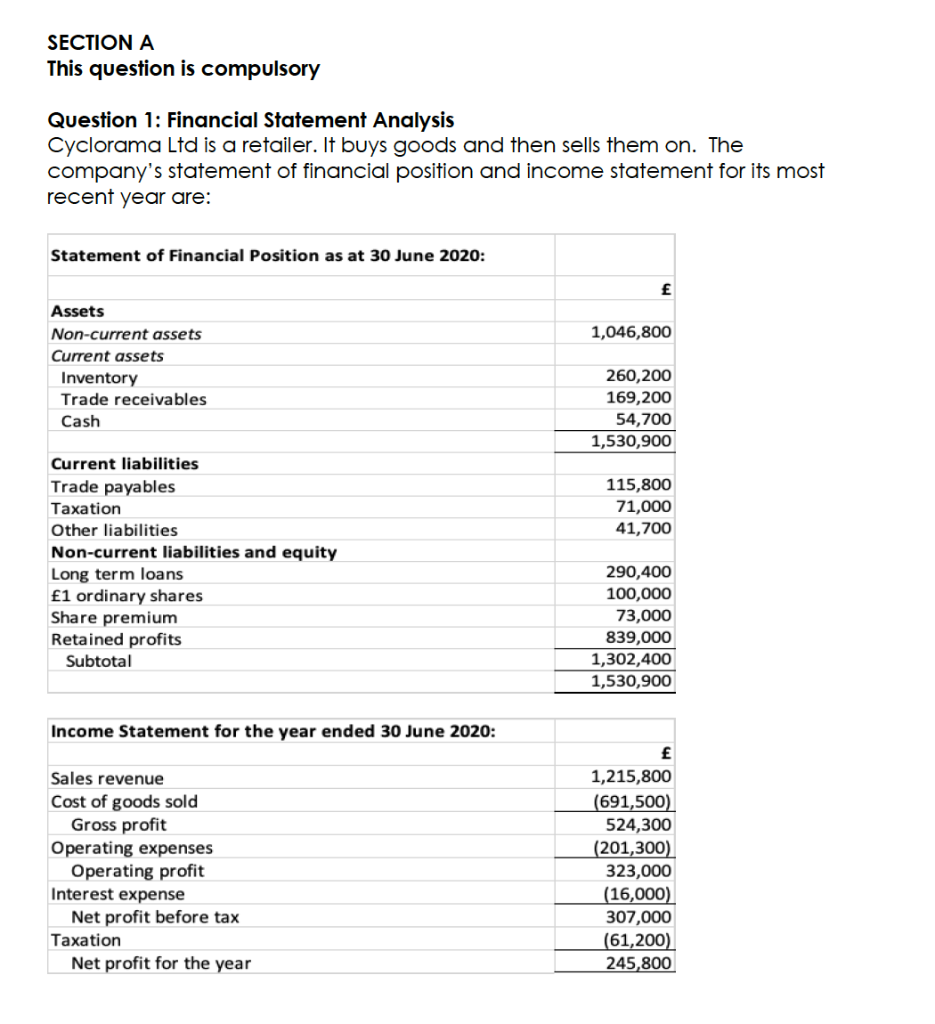

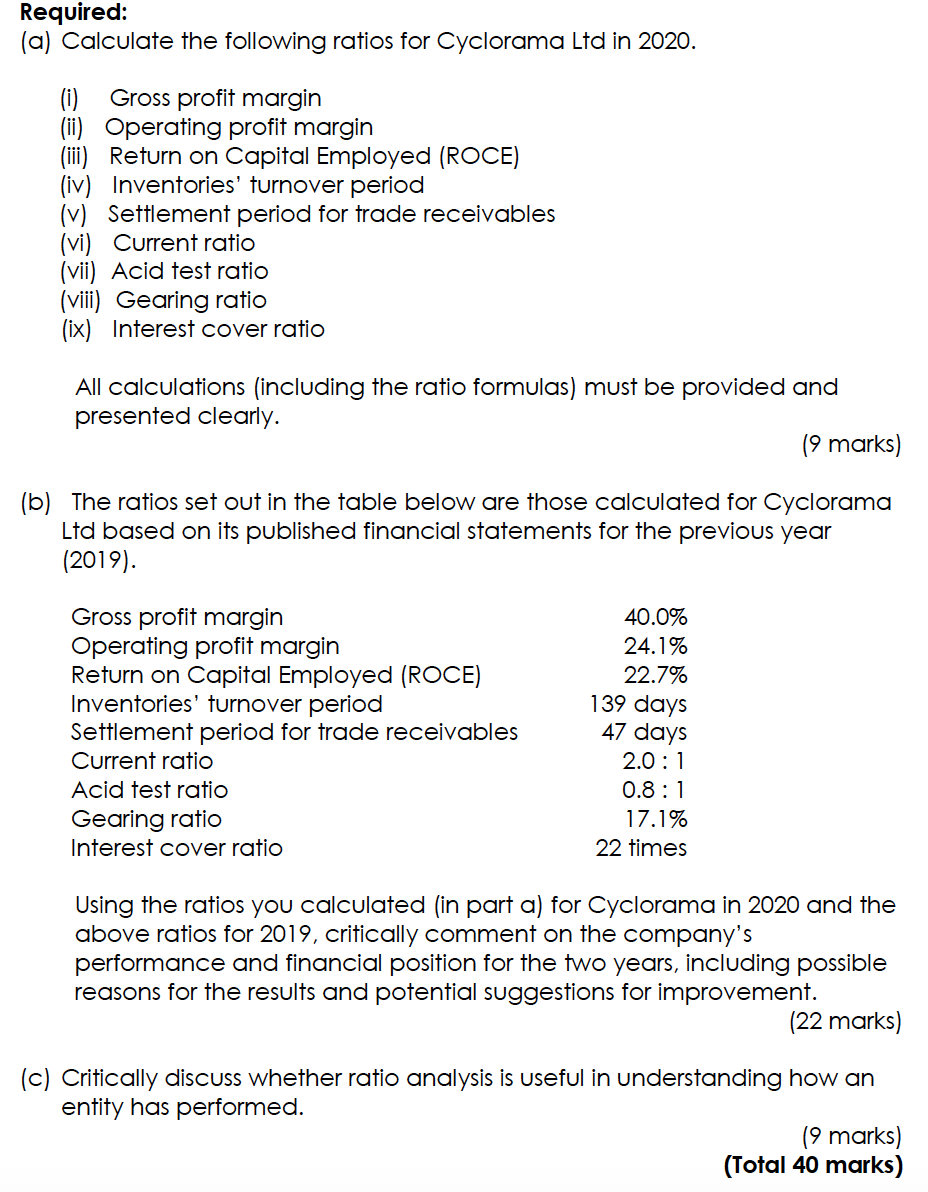

SECTION A This question is compulsory Question 1: Financial Statement Analysis Cyclorama Ltd is a retailer. It buys goods and then sells them on. The company's statement of financial position and income statement for its most recent year are: Statement of Financial Position as at 30 June 2020: 1,046,800 Assets Non-current assets Current assets Inventory Trade receivables Cash 260,200 169,200 54,700 1,530,900 115,800 71,000 41,700 Current liabilities Trade payables Taxation Other liabilities Non-current liabilities and equity Long term loans 1 ordinary shares Share premium Retained profits Subtotal 290,400 100,000 73,000 839,000 1,302,400 1,530,900 Income Statement for the year ended 30 June 2020: Sales revenue Cost of goods sold Gross profit Operating expenses Operating profit Interest expense Net profit before tax Taxation Net profit for the year E 1,215,800 (691,500) 524,300 (201,300) 323,000 (16,000) 307,000 (61,200) 245,800 Required: (a) Calculate the following ratios for Cyclorama Ltd in 2020. (i) Gross profit margin (ii) Operating profit margin (iii) Return on Capital Employed (ROCE) (iv) Inventories' turnover period (v) Settlement period for trade receivables (vi) Current ratio (vii) Acid test ratio (viii) Gearing ratio (ix) Interest cover ratio All calculations (including the ratio formulas) must be provided and presented clearly. (9 marks) (b) The ratios set out in the table below are those calculated for Cyclorama Ltd based on its published financial statements for the previous year (2019). Gross profit margin Operating profit margin Return on Capital Employed (ROCE) Inventories' turnover period Settlement period for trade receivables Current ratio Acid test ratio Gearing ratio Interest cover ratio 40.0% 24.1% 22.7% 139 days 47 days 2.0:1 0.8:1 17.1% 22 times Using the ratios you calculated (in part a) for Cyclorama in 2020 and the above ratios for 2019, critically comment on the company's performance and financial position for the two years, including possible reasons for the results and potential suggestions for improvement. (22 marks) (c) Critically discuss whether ratio analysis is useful in understanding how an entity has performed. (9 marks) (Total 40 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts