Question: SECTION B (30 MARKS) ATTEMPT ALL QUESTIONS IN THIS SECTION QUESTION ONE (20 MARKS) On 1 January 2018, Ohemaa Ltd. acquired 75% of Adepa Ltd.

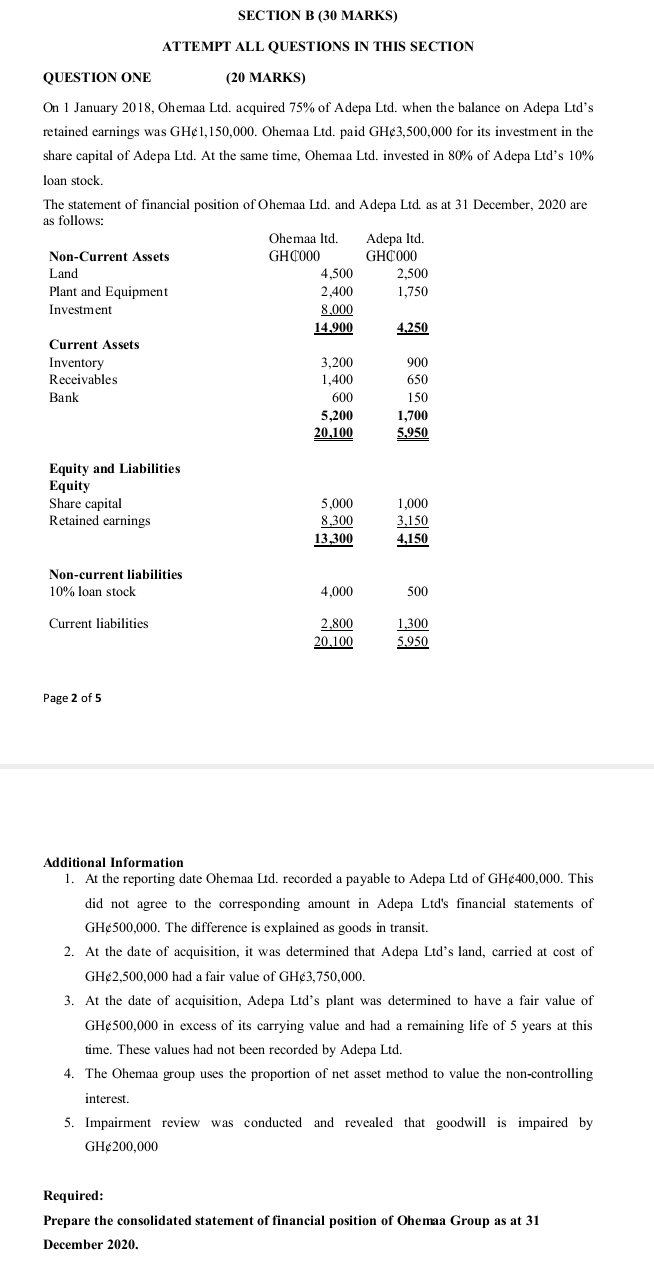

SECTION B (30 MARKS) ATTEMPT ALL QUESTIONS IN THIS SECTION QUESTION ONE (20 MARKS) On 1 January 2018, Ohemaa Ltd. acquired 75% of Adepa Ltd. when the balance on Adepa Ltd's retained earnings was GH1,150,000. Ohemaa Ltd. paid GH3,500,000 for its investment in the share capital of Adepa Ltd. At the same time, Ohemaa Ltd. invested in 80% of Adepa Ltd's 10% loan stock. The statement of financial position of Ohemaa Ltd. and Adepa Ltd. as at 31 December, 2020 are as follows: Ohemaa Itd. Adepa Itd. Non-Current Assets GHC000 GHC000 Land Plant and Equipment 2,400 1,750 Investment 8.000 14.900 4.250 Current Assets Inventory 3,200 900 Receivables 1,400 650 Bank 600 150 4,500 2,500 5,200 1,700 20,100 5,950 Equity and Liabilities Equity Share capital Retained earnings 5,000 8,300 13,300 1,000 3,150 4,150 Non-current liabilities 10% loan stock 4,000 500 Current liabilities 2,800 20,100 1,300 5,950 Page 2 of 5 Additional Information 1. At the reporting date Ohemaa Ltd. recorded a payable to Adepa Ltd of GH400,000. This did not agree to the corresponding amount in Adepa Ltd's financial statements of GH500,000. The difference is explained as goods in transit. 2. At the date of acquisition, it was determined that Adepa Ltd's land, carried at cost of GH2,500,000 had a fair value of GH3,750,000. 3. At the date of acquisition, Adepa Ltd's plant was determined to have a fair value of GH500,000 in excess of its carrying value and had a remaining life of 5 years at this time. These values had not been recorded by Adepa Ltd. 4. The Ohemaa group uses the proportion of net asset method to value the non-controlling interest. 5. Impairment review was conducted and revealed that goodwill is impaired by GH200,000 Required: Prepare the consolidated statement of financial position of Ohemaa Group as at 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts