Question: SECTION B (40 Marks) Answer ALL questions from this section. Question 1 (total: 5 marks) What are the functions of the Board of Inland Review?

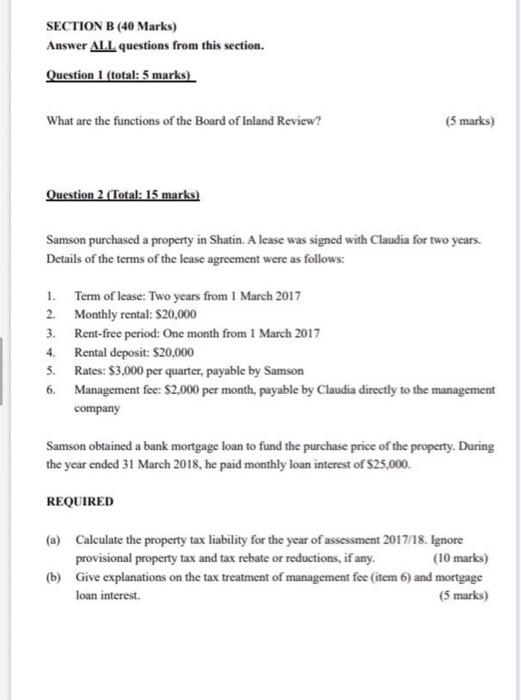

SECTION B (40 Marks) Answer ALL questions from this section. Question 1 (total: 5 marks) What are the functions of the Board of Inland Review? (5 marks) Question 2 (Total: 15 marks) Samson purchased a property in Shatin. A lcase was signed with Claudia for two years. Details of the terms of the lease agreement were as follows: 1. Term of lease: Two years from 1 March 2017 2. Monthly rental: $20,000 3. Rent-free period: One month from 1 March 2017 4. Rental deposit: $20,000 5. Rates: $3,000 per quarter, payable by Samson 6. Management fee: $2,000 per month, payable by Claudia directly to the management company Samson obtained a bank mortgage loan to fund the purchase price of the property. During the year ended 31 March 2018, he paid monthly loan interest of S25,000. REQUIRED (a) Calculate the property tax liability for the year of assessment 2017/18. Ignore provisional property tax and tax rebate or reductions, if any. (10 marks) (b) Give explanations on the tax treatment of management fee (item 6) and mortgage loan interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts