Question: SECTION B: 80 MARKS here are FIVE (5) questions in this section. Choose ANY FOUR (4) questions. Each question carries 20 marks. QUESTION 1: P/E

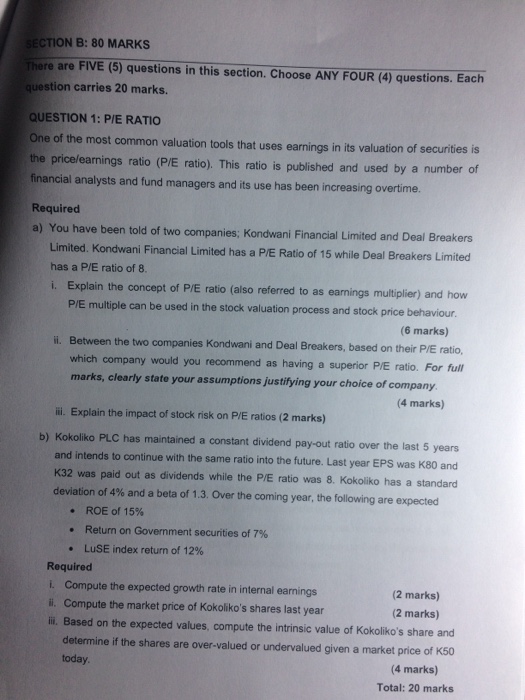

SECTION B: 80 MARKS here are FIVE (5) questions in this section. Choose ANY FOUR (4) questions. Each question carries 20 marks. QUESTION 1: P/E RATIO One of the most common valuation tools that uses earnings in its valuation of securities is the price/earnings ratio (PIE ratio). This ratio is published and used by a number of financial analysts and fund managers and its use has been increasing overtime. Required a) You have been told of two companies; Kondwani Financial Limited and Deal Breakers Limited. Kondwani Financial Limited has a P/E Ratio of 15 while Deal Breakers Limited has a P/E ratio of 8. Explain the concept of P/E ratio (also referred to as earnings multiplier) and how P/E multiple can be used in the stock valuation process and stock price behaviour. i. (6 marks) i. Between the two companies Kondwani and Deal Breakers, based on their P/E ratio, which company would you recommend as having a superior P/E ratio. For ful marks, clearly state your assumptions justifying your choice of company 4 marks) ili. Explain the impact of stock risk on P/E ratios (2 marks) b) Kokoliko PLC has maintained a constant dividend pay-out ratio over the last 5 years and intends to continue with the same ratio into the future. Last year EPS was K80 and K32 was paid out as dividends while the P/E ratio was 8. Kokoliko has a standard deviation of 4% and a beta of 1.3. Over the coming year, the following are expected ROE of 15% Return on Government securities of 7% LuSE index return of 12% Required i. Compute the expected growth rate in internal earnings i. Compute the market price of Kokoliko's shares last year ili. Based on the expected values, compute the intrinsic value of Kokoliko's share and (2 marks) (2 marks) determine if the shares are over-valued or undervalued given a market price of K50 today (4 marks) Total: 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts