Question: SECTION B Answer one question and no more than two further questions from this section. 5. A firm is considering investing in the following two

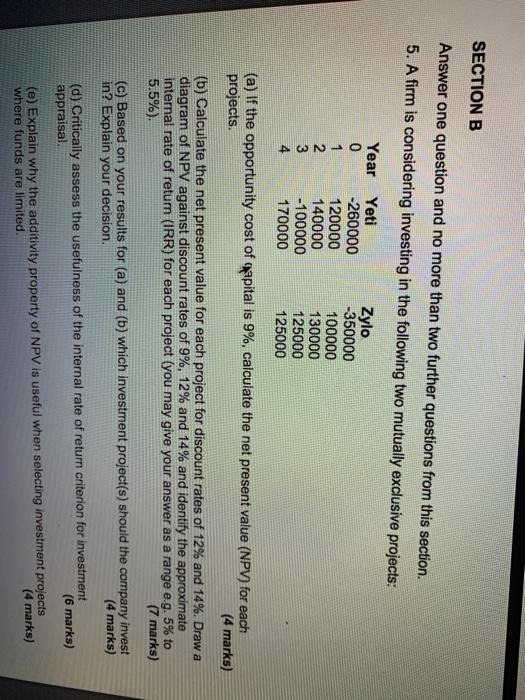

SECTION B Answer one question and no more than two further questions from this section. 5. A firm is considering investing in the following two mutually exclusive projects: Year 0 1 2 3 4 Yeti -260000 120000 140000 -100000 170000 Zylo -350000 100000 130000 125000 125000 (a) If the opportunity cost of capital is 9%, calculate the net present value (NPV) for each projects. (4 marks) (b) Calculate the net present value for each project for discount rates of 12% and 14%. Draw a diagram of NPV against discount rates of 9%, 12% and 14% and identify the approximate internal rate of retum (IRR) for each project (you may give your answer as a range e.g. 5% to 5.5%) (7 marks) (c) Based on your results for (a) and (b) which investment project(s) should the company invest in? Explain your decision. (4 marks) (d) Critically assess the usefulness of the internal rate of return criterion for investment appraisal. (6 marks) (e) Explain why the additivity property of NPV is useful when selecting investment projects where funds are limited. (4 marks) SECTION B Answer one question and no more than two further questions from this section. 5. A firm is considering investing in the following two mutually exclusive projects: Year 0 1 2 3 4 Yeti -260000 120000 140000 -100000 170000 Zylo -350000 100000 130000 125000 125000 (a) If the opportunity cost of capital is 9%, calculate the net present value (NPV) for each projects. (4 marks) (b) Calculate the net present value for each project for discount rates of 12% and 14%. Draw a diagram of NPV against discount rates of 9%, 12% and 14% and identify the approximate internal rate of retum (IRR) for each project (you may give your answer as a range e.g. 5% to 5.5%) (7 marks) (c) Based on your results for (a) and (b) which investment project(s) should the company invest in? Explain your decision. (4 marks) (d) Critically assess the usefulness of the internal rate of return criterion for investment appraisal. (6 marks) (e) Explain why the additivity property of NPV is useful when selecting investment projects where funds are limited. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts