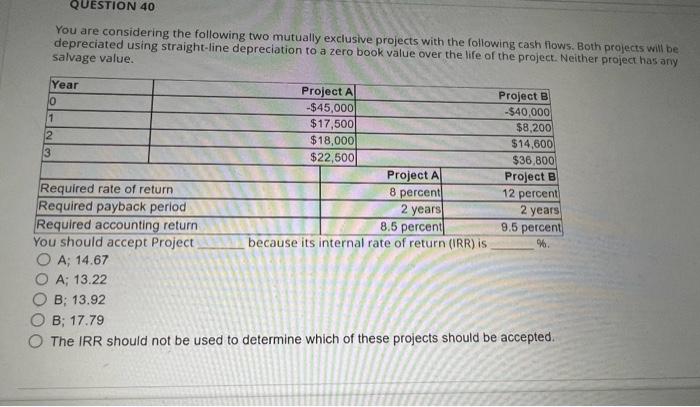

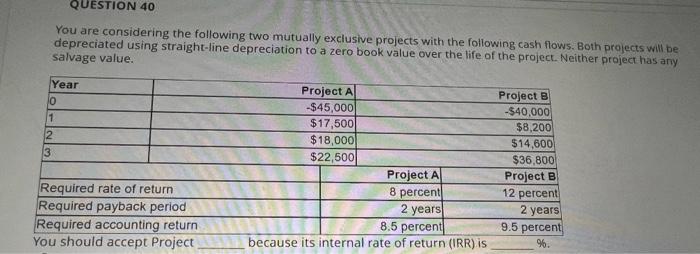

Question: You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero

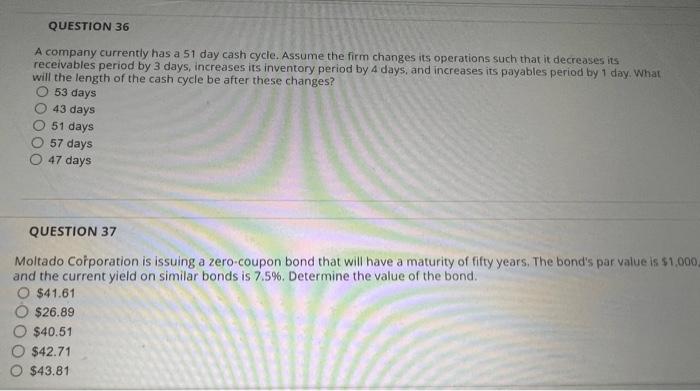

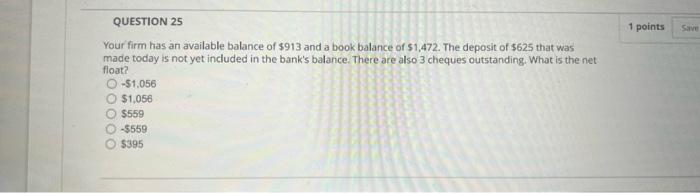

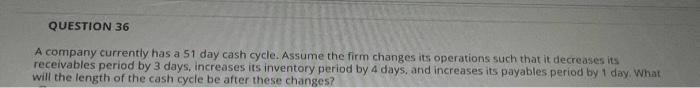

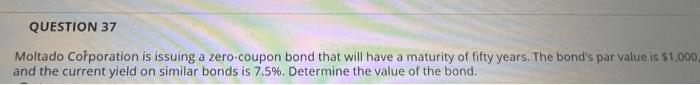

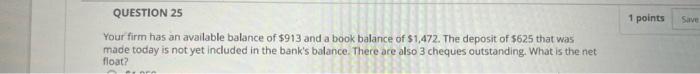

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has arly salvage value. You snoula accept project because its internal rate of return (IRR) is A; 14.67 A; 13.22 B: 13.92 B; 17.79 The IRR should not be used to determine which of these projects should be accepted. A company currently has a 51 day cash cycle. Assume the firm changes its operations such that it decreases its receivables period by 3 days, increases its inventory period by 4 days, and increases its payables period by 1 day, What will the length of the cash cycle be after these changes? 53 days 43 days 51 days 57 days 47 days QUESTION 37 Moltado Corporation is issuing a zero-coupon bond that will have a maturity of fifty years, The bond's par value is $1,000 and the current yield on similar bonds is 7.5%. Determine the value of the bond. $41.61 $26.89 $40.51 $42.71 $43.81 Your firm has an available balance of $913 and a book balance of $1,472. The deposit of 5625 that was made today is not yet included in the bank's balance. There are also 3 cheques outstanding. What is the net float? $1,056$1,056$559$559$395 You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value. QUESTION 36 A company currently has a 51 day cash cycle. Assume the firm changes its operations such that it decreases its receivables period by 3 days, increases its inventory period by 4 days, and increases its payables period by 1 day, What will the length of the cash cycle be after these changes? Moltado Corporation is issuing a zero-coupon bond that will have a maturity of fifty years. The bond's par value is $1,000 and the current yield on similar bonds is 7.5%. Determine the value of the bond. Your firm has an available balance of $913 and a book balance of $1,472. The deposit of $625 that was made today is not yet included in the bank's balance. There are also 3 cheques outstanding. What is the net float

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts