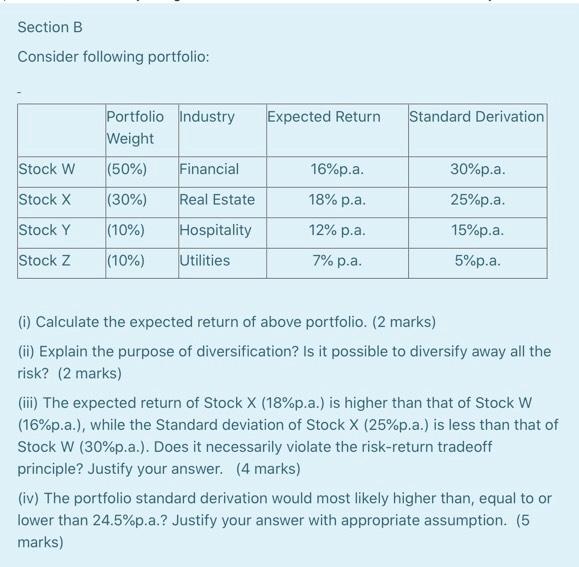

Question: Section B Consider following portfolio: Expected Return Standard Derivation Stock W 16%p.a. 30%p.a. Portfolio Industry Weight (50%) Financial (30%) Real Estate (10%) Hospitality (10%) Utilities

Section B Consider following portfolio: Expected Return Standard Derivation Stock W 16%p.a. 30%p.a. Portfolio Industry Weight (50%) Financial (30%) Real Estate (10%) Hospitality (10%) Utilities Stock X 18% p.a. 25%p.a. Stock Y 12% p.a. 15%p.a. Stock Z 7% p.a. 5%p.a. (1) Calculate the expected return of above portfolio. (2 marks) (ii) Explain the purpose of diversification? Is it possible to diversify away all the risk? (2 marks) (iii) The expected return of Stock X (18%p.a.) is higher than that of Stock W (16%p.a.), while the Standard deviation of Stock X (25%p.a.) is less than that of Stock W (30%p.a.). Does it necessarily violate the risk-return tradeoff principle? Justify your answer. (4 marks) (iv) The portfolio standard derivation would most likely higher than, equal to or lower than 24.5%p.a.? Justify your answer with appropriate assumption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts