Question: Section B... Definitions c (1) Corporate bonds that are not secured by pledged assets, but by the issuing corporation's good financial standing (2) Corporate bonds

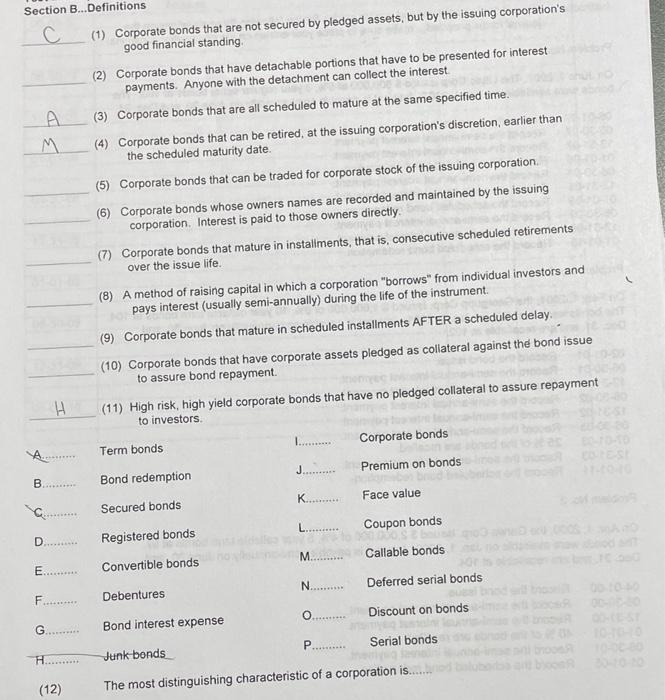

Section B... Definitions c (1) Corporate bonds that are not secured by pledged assets, but by the issuing corporation's good financial standing (2) Corporate bonds that have detachable portions that have to be presented for interest payments. Anyone with the detachment can collect the interest . (3) Corporate bonds that are all scheduled to mature at the same specified time. M (4) Corporate bonds that can be retired, at the issuing corporation's discretion, earlier than the scheduled maturity date. (5) Corporate bonds that can be traded for corporate stock of the issuing corporation (6) Corporate bonds whose owners names are recorded and maintained by the issuing corporation. Interest is paid to those owners directly (7) Corporate bonds that mature in installments, that is, consecutive scheduled retirements over the issue life. (8) A method of raising capital in which a corporation "borrows" from individual investors and pays interest (usually semi-annually during the life of the instrument (9) Corporate bonds that mature in scheduled installments AFTER a scheduled delay. (10) Corporate bonds that have corporate assets pledged as collateral against the bond issue to assure bond repayment. H (11) High risk, high yield corporate bonds that have no pledged collateral to assure repayment to investors Term bonds Corporate bonds B Bond redemption J Premium on bonds Secured bonds K........... Face value D Registered bonds L. ......... Coupon bonds Convertible bonds M Callable bonds E......... N. Deferred serial bonds F Debentures O Discount on bonds G....... Bond interest expense P........ Serial bonds H. Junk bonds (12) The most distinguishing characteristic of a corporation is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts