Question: SECTION B: MANAGEMENT ACCOUNTING [50 MARKS] Question 1 (14 marks) Mojela, a movie producer, and director at Mzansi Studios is considering investing R12 000 in

SECTION B: MANAGEMENT ACCOUNTING [50 MARKS] Question 1 (14 marks)

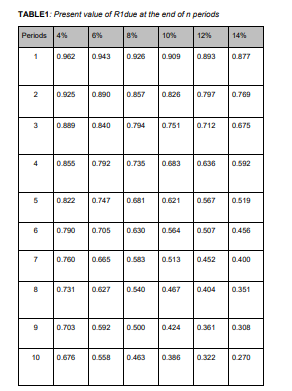

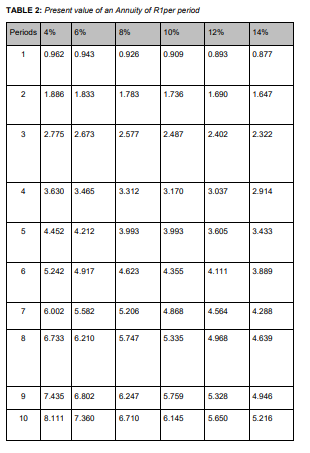

Mojela, a movie producer, and director at Mzansi Studios is considering investing R12 000 in an AI project to improve the creative and writing skills of his team. The Department of trade and Industry has agreed to finance the project if Mojela pays upfront R5 000 into the project. The project will generate the following cash flows:

![SECTION B: MANAGEMENT ACCOUNTING [50 MARKS] Question 1 (14 marks) Mojela, a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717dd45084fb_2206717dd4499b57.jpg)

Mojela requires a minimum rate of return of 8%.

Required: 1.1. Calculate the net present value of the investment? Would you recommend that Mojela continue with this project? Substantiate your answer. (7)

1.2. Determine the projects payback period? (3) 1.3. Distinguish between the NPV method and payback period. (4)

Use the following tables:

\begin{tabular}{|c|c|c|} \hline YEAR & \begin{tabular}{l} REVENUES \\ R \end{tabular} & EXPENSES \\ \hline 1 & 20000 & 18000 \\ \hline 2 & 22000 & 19000 \\ \hline 3 & 22000 & 20000 \\ \hline 4 & 22000 & 17000 \\ \hline 5 & 25000 & 17000 \\ \hline \end{tabular} TABLE 2: Present value of an Antuity of Riper period \begin{tabular}{|c|l|l|l|l|l|l|} \hline Periods & 4% & 6% & 8% & 10% & 12% & 14% \\ \hline 1 & 0.962 & 0.943 & 0.926 & 0.909 & 0.893 & 0.877 \\ \hline 2 & 1.886 & 1.833 & 1.783 & 1.736 & 1.690 & 1.647 \\ \hline 3 & 2.775 & 2.673 & 2.577 & 2.487 & 2.402 & 2.322 \\ \hline 4 & 3.630 & 3.465 & 3.312 & 3.170 & 3.037 & 2.914 \\ \hline 5 & 4.452 & 4.212 & 3.996 & 3.993 & 3.605 & 3.433 \\ \hline 7 & 6.002 & 5.582 & 5.206 & 4.868 & 4.564 & 4.288 \\ \hline 8 & 5.242 & 4.917 & 4.623 & 4.355 & 4.111 & 3.889 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} TABLE1: Present value of R1due at the end of n periods \begin{tabular}{|c|l|l|l|l|l|l|} \hline Peribds & 4% & 6% & 8% & 10% & 12% & 14% \\ \hline 1 & 0.962 & 0.943 & 0.926 & 0.909 & 0.893 & 0.877 \\ \hline 2 & 0.925 & 0.890 & 0.857 & 0.826 & 0.797 & 0.769 \\ \hline 3 & 0.859 & 0.840 & 0.794 & 0.751 & 0.712 & 0.675 \\ \hline 4 & 0.855 & 0.792 & 0.735 & 0.683 & 0.636 & 0.592 \\ \hline 5 & 0.822 & 0.747 & 0.681 & 0.621 & 0.567 & 0.519 \\ \hline 6 & 0.790 & 0.705 & 0.630 & 0.564 & 0.507 & 0.456 \\ \hline 7 & 0.760 & 0.655 & 0.583 & 0.513 & 0.452 & 0.400 \\ \hline 8 & 0.731 & 0.627 & 0.540 & 0.467 & 0.404 & 0.351 \\ \hline 10 & 0.676 & 0.558 & 0.463 & 0.386 & 0.322 & 0.270 \\ \hline & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts