Question: Section B: Practical Questions (20 points each; 40 points in total) Write down your answer in BALL PEN on the designated answer booklet. Question 1

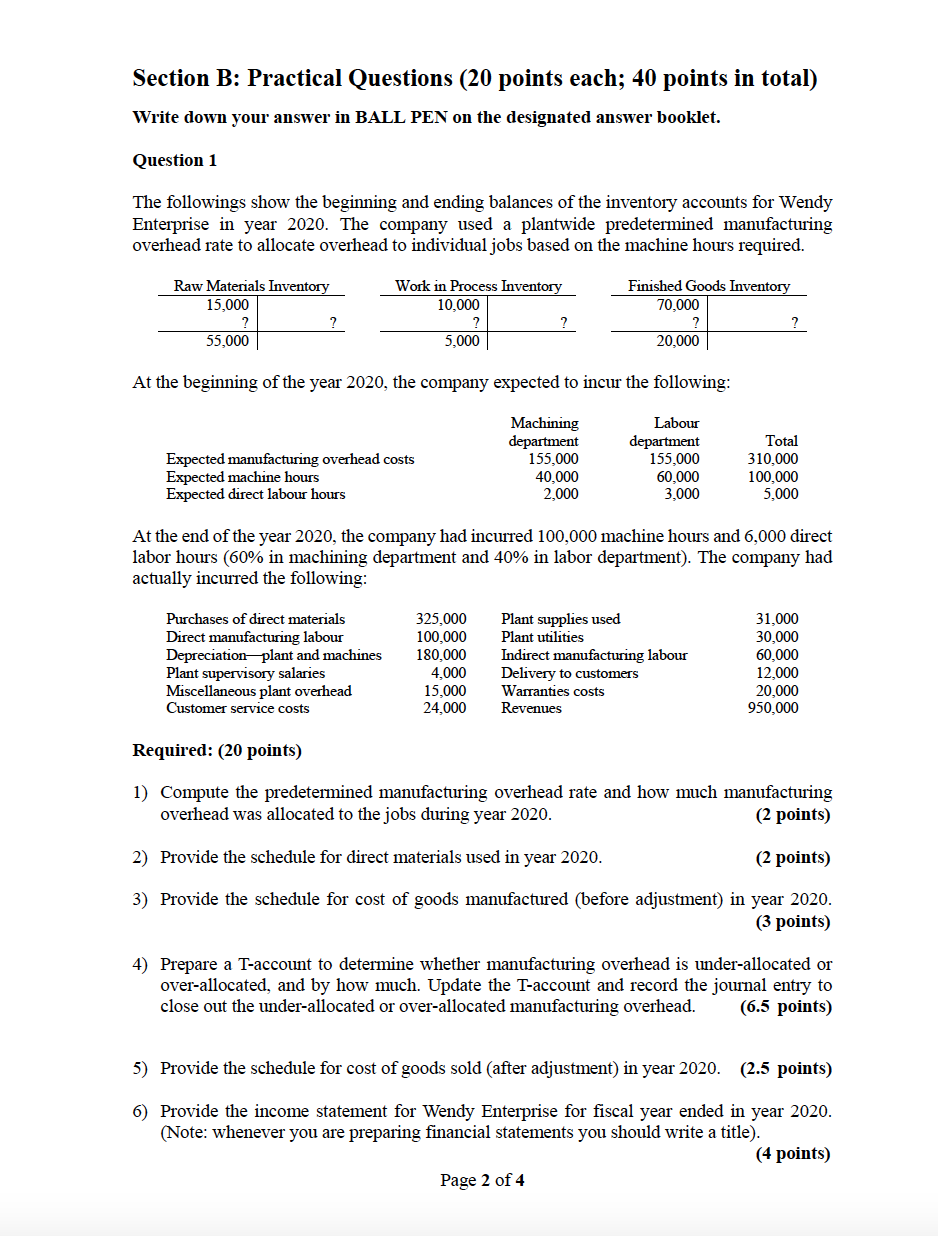

Section B: Practical Questions (20 points each; 40 points in total) Write down your answer in BALL PEN on the designated answer booklet. Question 1 The followings show the beginning and ending balances of the inventory accounts for Wendy Enterprise in year 2020. The company used a plantwide predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. Work in Process Inventory 10,000 Raw Materials Inventory 15,000 ? 55,000 Finished Goods Inventory 70,000 ? 20,000 5,000 At the beginning of the year 2020, the company expected to incur the following: Expected manufacturing overhead costs Expected machine hours Expected direct labour hours Machining department 155,000 40,000 2,000 Labour department 155,000 60,000 3,000 Total 310,000 100,000 5,000 At the end of the year 2020, the company had incurred 100,000 machine hours and 6,000 direct labor hours (60% in machining department and 40% in labor department). The company had actually incurred the following: Purchases of direct materials Direct manufacturing labour Depreciation plant and machines Plant supervisory salaries Miscellaneous plant overhead Customer service costs 325,000 100,000 180,000 4,000 15,000 24,000 Plant supplies used Plant utilities Indirect manufacturing labour Delivery to customers Warranties costs Revenues 31,000 30,000 60.000 12.000 20,000 950,000 Required: (20 points) 1) Compute the predetermined manufacturing overhead rate and how much manufacturing overhead was allocated to the jobs during year 2020. (2 points) 2) Provide the schedule for direct materials used in year 2020. (2 points) 3) Provide the schedule for cost of goods manufactured (before adjustment) in year 2020. (3 points) 4) Prepare a T-account to determine whether manufacturing overhead is under-allocated or over-allocated, and by how much. Update the T-account and record the journal entry to close out the under-allocated or over-allocated manufacturing overhead. (6.5 points) 5) Provide the schedule for cost of goods sold (after adjustment) in year 2020. (2.5 points) 6) Provide the income statement for Wendy Enterprise for fiscal year ended in year 2020. (Note: whenever you are preparing financial statements you should write a title). (4 points) Page 2 of 4 Section B: Practical Questions (20 points each; 40 points in total) Write down your answer in BALL PEN on the designated answer booklet. Question 1 The followings show the beginning and ending balances of the inventory accounts for Wendy Enterprise in year 2020. The company used a plantwide predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. Work in Process Inventory 10,000 Raw Materials Inventory 15,000 ? 55,000 Finished Goods Inventory 70,000 ? 20,000 5,000 At the beginning of the year 2020, the company expected to incur the following: Expected manufacturing overhead costs Expected machine hours Expected direct labour hours Machining department 155,000 40,000 2,000 Labour department 155,000 60,000 3,000 Total 310,000 100,000 5,000 At the end of the year 2020, the company had incurred 100,000 machine hours and 6,000 direct labor hours (60% in machining department and 40% in labor department). The company had actually incurred the following: Purchases of direct materials Direct manufacturing labour Depreciation plant and machines Plant supervisory salaries Miscellaneous plant overhead Customer service costs 325,000 100,000 180,000 4,000 15,000 24,000 Plant supplies used Plant utilities Indirect manufacturing labour Delivery to customers Warranties costs Revenues 31,000 30,000 60.000 12.000 20,000 950,000 Required: (20 points) 1) Compute the predetermined manufacturing overhead rate and how much manufacturing overhead was allocated to the jobs during year 2020. (2 points) 2) Provide the schedule for direct materials used in year 2020. (2 points) 3) Provide the schedule for cost of goods manufactured (before adjustment) in year 2020. (3 points) 4) Prepare a T-account to determine whether manufacturing overhead is under-allocated or over-allocated, and by how much. Update the T-account and record the journal entry to close out the under-allocated or over-allocated manufacturing overhead. (6.5 points) 5) Provide the schedule for cost of goods sold (after adjustment) in year 2020. (2.5 points) 6) Provide the income statement for Wendy Enterprise for fiscal year ended in year 2020. (Note: whenever you are preparing financial statements you should write a title). (4 points) Page 2 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts