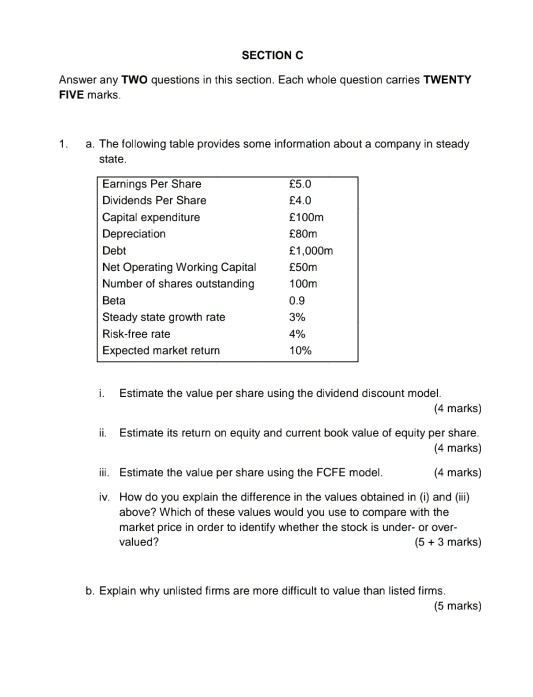

Question: SECTION C Answer any TWO questions in this section. Each whole question carries TWENTY FIVE marks 1. a. The following table provides some information about

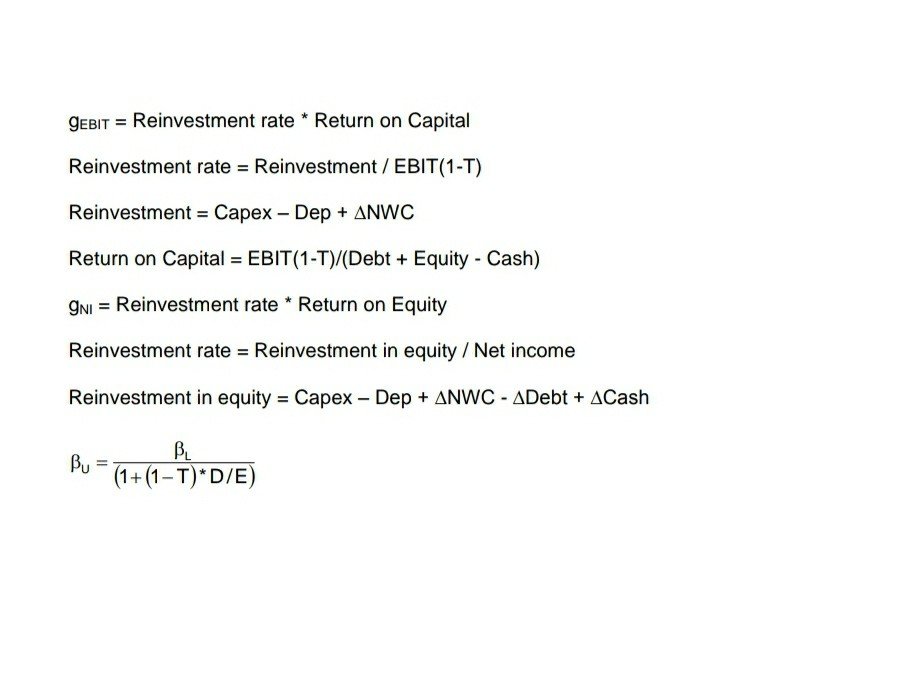

SECTION C Answer any TWO questions in this section. Each whole question carries TWENTY FIVE marks 1. a. The following table provides some information about a company in steady state. Earnings Per Share Dividends Per Share Capital expenditure Depreciation Debt Net Operating Working Capital Number of shares outstanding Beta Steady state growth rate Risk-free rate Expected market return 5.0 4.0 100m 80m 1,000m 50m 100m 0.9 4% 10% i Estimate the value per share using the dividend discount model (4 marks) ii Estimate its return on equity and current book value of equity per share (4 marks) ii. Estimate the value per share using the FCFE model. (4 marks) iv. How do you explain the difference in the values obtained in () and (ii) above? Which of these values would you use to compare with the market price in order to identify whether the stock is under or over valued? (5 + 3 marks) b. Explain why unlisted firms are more difficult to value than listed firms (5 marks) Formula Sheet 1-1+9) Two-stage DDM Equity 1+ Div. (1+9H) K.-9. Div 1 (k-9N)*(1+k Two-stage RIM Equity, = BV, + RI+ RU + (1+KOH (ken -9N)*(1+keH Intrinsic P/E ratio P. E = Payout ratio* (1+g) K-9 (1-g/RoE)*(1+g) K -9 Intrinsic EV/EBITDA ratio EBITDA Dep*T (1-1)+EBITDA Capex ANWC](1+g) EBITDA EBITDA K-9 Intrinsic P/B ratio P BV. ROE Payout ratio RoE-9 ko-g ko-g Call value = Se" "N(d1) - Xe"N(d2) Put value = Xe 'N(-d2) - SN(-da) Where dIn(S/X)+(r-q+0.5*o IT AVT ) d. In(S/X)+(-9-0.5. CAVT Probability of bankruptcy = N(-d2) GEBIT = Reinvestment rate * Return on Capital Reinvestment rate = Reinvestment / EBIT(1-T) Reinvestment = Capex Dep + ANWC Return on Capital = EBIT(1-T)/(Debt + Equity - Cash) ONI = Reinvestment rate * Return on Equity Reinvestment rate = Reinvestment in equity / Net income Reinvestment in equity = Capex - Dep + ANWC - ADebt + ACash Bu = (1+(1 - T)*D/E) SECTION C Answer any TWO questions in this section. Each whole question carries TWENTY FIVE marks 1. a. The following table provides some information about a company in steady state. Earnings Per Share Dividends Per Share Capital expenditure Depreciation Debt Net Operating Working Capital Number of shares outstanding Beta Steady state growth rate Risk-free rate Expected market return 5.0 4.0 100m 80m 1,000m 50m 100m 0.9 4% 10% i Estimate the value per share using the dividend discount model (4 marks) ii Estimate its return on equity and current book value of equity per share (4 marks) ii. Estimate the value per share using the FCFE model. (4 marks) iv. How do you explain the difference in the values obtained in () and (ii) above? Which of these values would you use to compare with the market price in order to identify whether the stock is under or over valued? (5 + 3 marks) b. Explain why unlisted firms are more difficult to value than listed firms (5 marks) Formula Sheet 1-1+9) Two-stage DDM Equity 1+ Div. (1+9H) K.-9. Div 1 (k-9N)*(1+k Two-stage RIM Equity, = BV, + RI+ RU + (1+KOH (ken -9N)*(1+keH Intrinsic P/E ratio P. E = Payout ratio* (1+g) K-9 (1-g/RoE)*(1+g) K -9 Intrinsic EV/EBITDA ratio EBITDA Dep*T (1-1)+EBITDA Capex ANWC](1+g) EBITDA EBITDA K-9 Intrinsic P/B ratio P BV. ROE Payout ratio RoE-9 ko-g ko-g Call value = Se" "N(d1) - Xe"N(d2) Put value = Xe 'N(-d2) - SN(-da) Where dIn(S/X)+(r-q+0.5*o IT AVT ) d. In(S/X)+(-9-0.5. CAVT Probability of bankruptcy = N(-d2) GEBIT = Reinvestment rate * Return on Capital Reinvestment rate = Reinvestment / EBIT(1-T) Reinvestment = Capex Dep + ANWC Return on Capital = EBIT(1-T)/(Debt + Equity - Cash) ONI = Reinvestment rate * Return on Equity Reinvestment rate = Reinvestment in equity / Net income Reinvestment in equity = Capex - Dep + ANWC - ADebt + ACash Bu = (1+(1 - T)*D/E)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts