Question: SECTION C - SHORT QUESTIONS ANSWER ALL QUESTIONS IN THIS SECTION QUESTION 1 Background: Arthur is an investment analyst working for Sigma Neutral Investment Ltd.

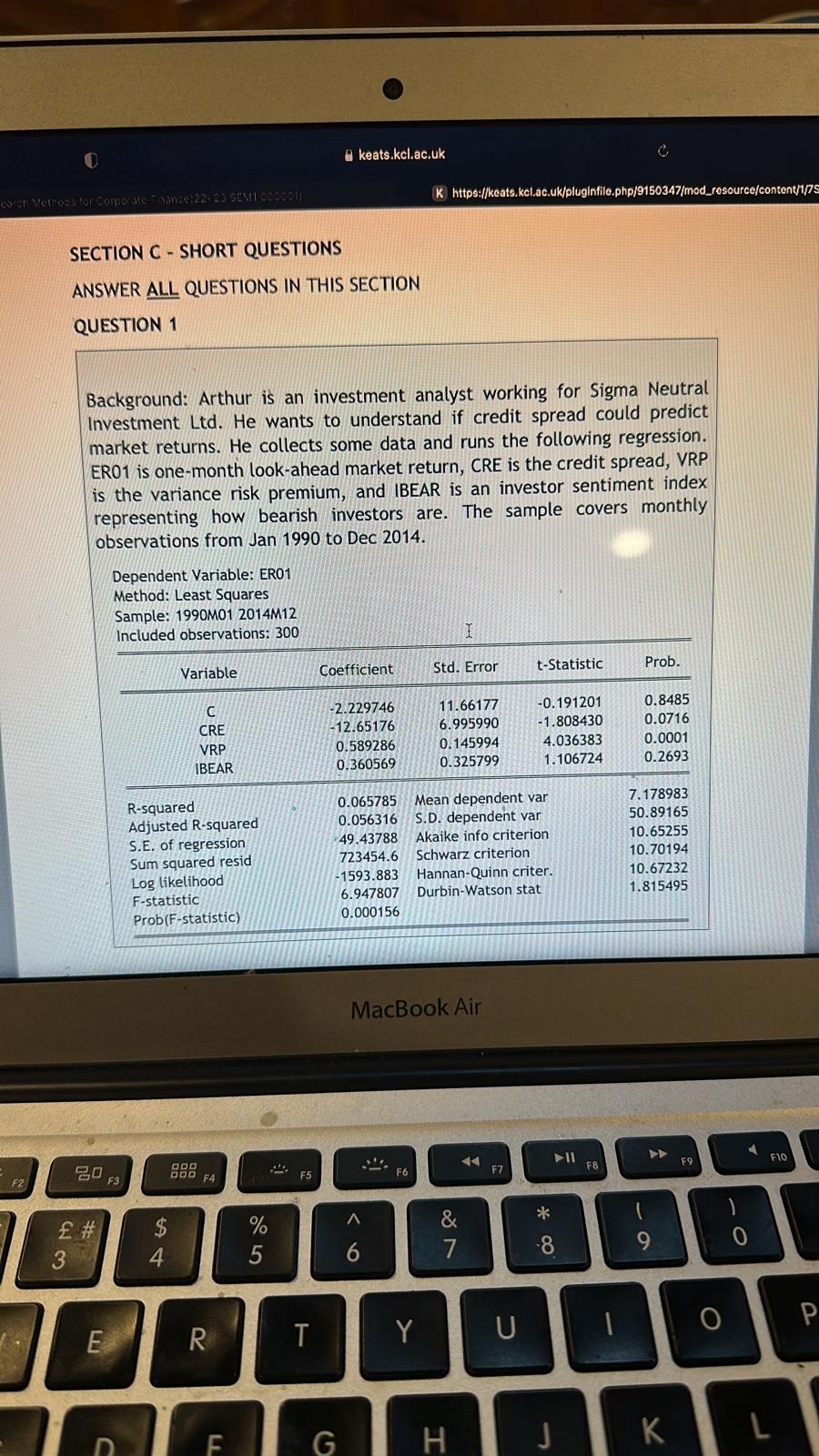

SECTION C - SHORT QUESTIONS ANSWER ALL QUESTIONS IN THIS SECTION QUESTION 1 Background: Arthur is an investment analyst working for Sigma Neutral Investment Ltd. He wants to understand if credit spread could predict market returns. He collects some data and runs the following regression. ER01 is one-month look-ahead market return, CRE is the credit spread, VRP is the variance risk premium, and IBEAR is an investor sentiment index representing how bearish investors are. The sample covers monthly observations from Jan 1990 to Dec 2014. Dependent Variable: ER01 Method: Least Squares Sample: 1990M01 2014M12 Included observations: 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts