Question: Section D - Use it your filing status is Head of household. Complete the row below that applies to you. Tax (a) Subtract id from

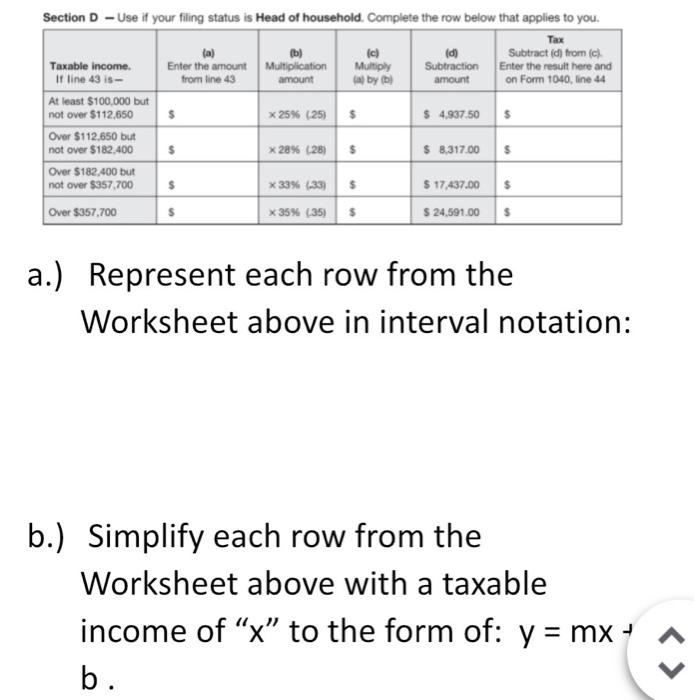

Section D - Use it your filing status is Head of household. Complete the row below that applies to you. Tax (a) Subtract id from (c) Taxable income. Enter the amount Multiplication Multiply Subtraction Enter the result here and If line 43 is- from line 43 amount by ( amount on Form 1040, line 44 At least $100,000 but not over $112,650 $ x 25% (25) $ 4,937.50 $ Over $112,650 but not over $182.400 $ x 28% (28) $ $ 8,317.00 $ Over $182,400 but not over $357.700 x 33% (-33) $ $ 17,437.00 $ Over $357,700 $ x 35% (35) $ $ 24,591.00 $ $ $ a.) Represent each row from the Worksheet above in interval notation: b.) Simplify each row from the Worksheet above with a taxable income of x to the form of: y = mx + b. Section D - Use it your filing status is Head of household. Complete the row below that applies to you. Tax (a) Subtract id from (c) Taxable income. Enter the amount Multiplication Multiply Subtraction Enter the result here and If line 43 is- from line 43 amount by ( amount on Form 1040, line 44 At least $100,000 but not over $112,650 $ x 25% (25) $ 4,937.50 $ Over $112,650 but not over $182.400 $ x 28% (28) $ $ 8,317.00 $ Over $182,400 but not over $357.700 x 33% (-33) $ $ 17,437.00 $ Over $357,700 $ x 35% (35) $ $ 24,591.00 $ $ $ a.) Represent each row from the Worksheet above in interval notation: b.) Simplify each row from the Worksheet above with a taxable income of x to the form of: y = mx + b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts