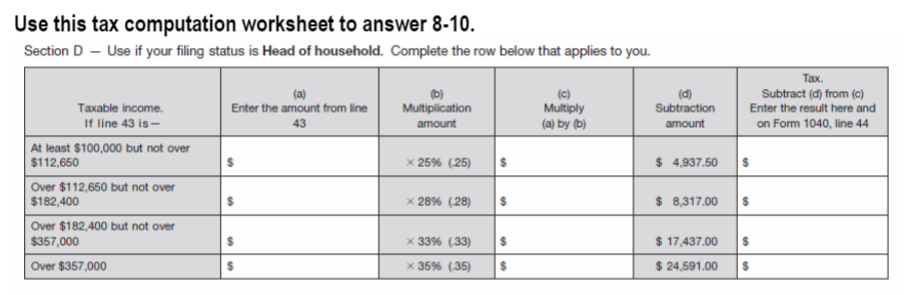

Question: Use this tax computation worksheet to answer 8-10. Section D - Use if your filing status is Head of household. Complete the row below that

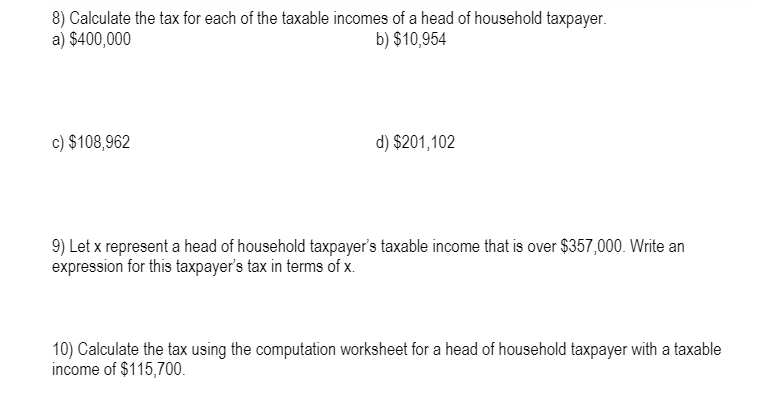

Use this tax computation worksheet to answer 8-10. Section D - Use if your filing status is Head of household. Complete the row below that applies to you. (a) Enter the amount from line 43 Multiplication amount (c) Multiply (a) by (6) (d) Subtraction amount Tax. Subtract (d) from (c) Enter the result here and on Form 1040, line 44 x 25% (-25) $ $ 4,937.50 $ Taxable income. If line 43 is - At least $100,000 but not over $112,650 Over $112,650 but not over $182,400 Over $182,400 but not over $357,000 Over $357,000 x 28% (28) $ 8,317.00 $ $ $ 17,437.00 x 33% (33) x 35% (35) $ $ 24,591.00 8) Calculate the tax for each of the taxable incomes of a head of household taxpayer. a) $400,000 b) $10,954 c) $108,962 d) $201,102 9) Let x represent a head of household taxpayer's taxable income that is over $357,000. Write an expression for this taxpayer's tax in terms of x. 10) Calculate the tax using the computation worksheet for a head of household taxpayer with a taxable income of $115,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts