Question: Section II: Short Question (60%) (20% for each) Question II.1. (20%) Given the following information about three assets available in the financial market: Asset: Expected

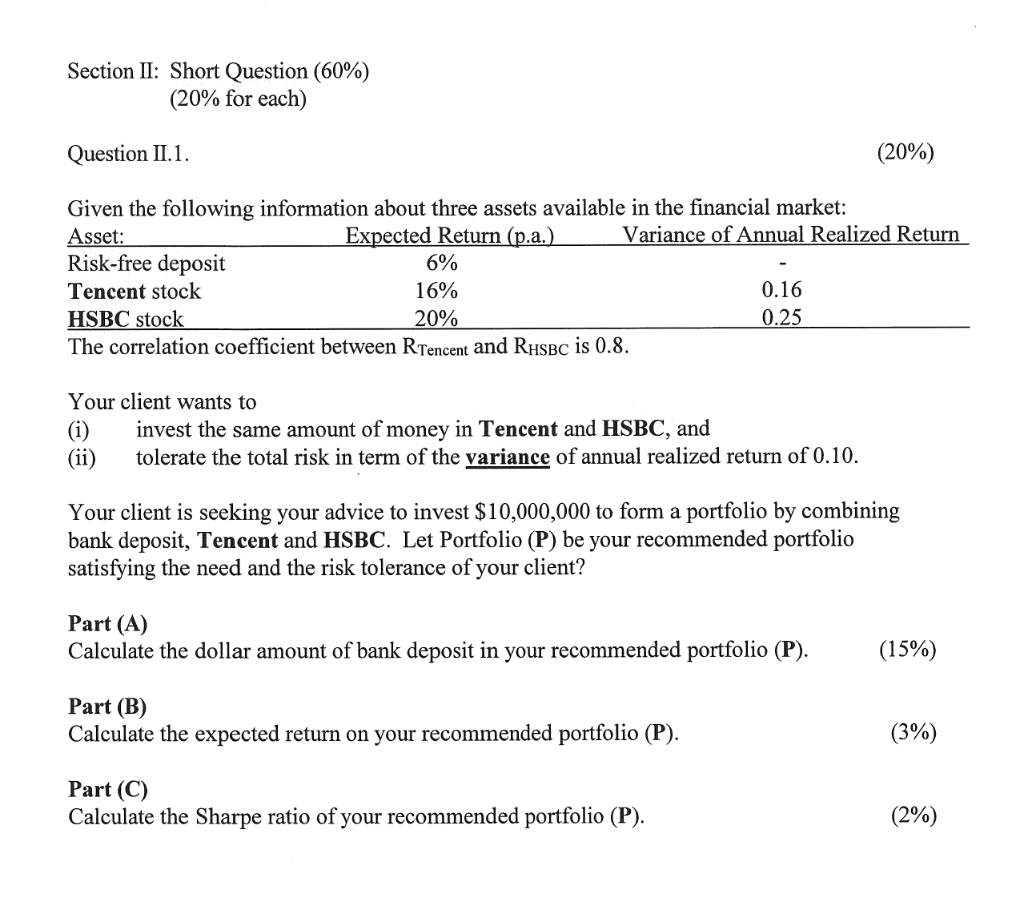

Section II: Short Question (60%) (20% for each) Question II.1. (20%) Given the following information about three assets available in the financial market: Asset: Expected Return (p.a.) Variance of Annual Realized Return Risk-free deposit 6% Tencent stock 16% 0.16 HSBC stock 20% 0.25 The correlation coefficient between RTencent and RHsbc is 0.8. Your client wants to (i) invest the same amount of money in Tencent and HSBC, and (ii) tolerate the total risk in term of the variance of annual realized return of 0.10. Your client is seeking your advice to invest $10,000,000 to form a portfolio by combining bank deposit, Tencent and HSBC. Let Portfolio (P) be your recommended portfolio satisfying the need and the risk tolerance of your client? Part (A) Calculate the dollar amount of bank deposit in your recommended portfolio (P). (15%) Part (B) Calculate the expected return on your recommended portfolio (P). (3%) Part (C) Calculate the Sharpe ratio of your recommended portfolio (P). (2%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts