Question: Section III: SHORT ANSWER QUESTIONS (6*5' = 30 points total, fering (IPO) process and explain the role of the underwriter, 1. Describe the initial public

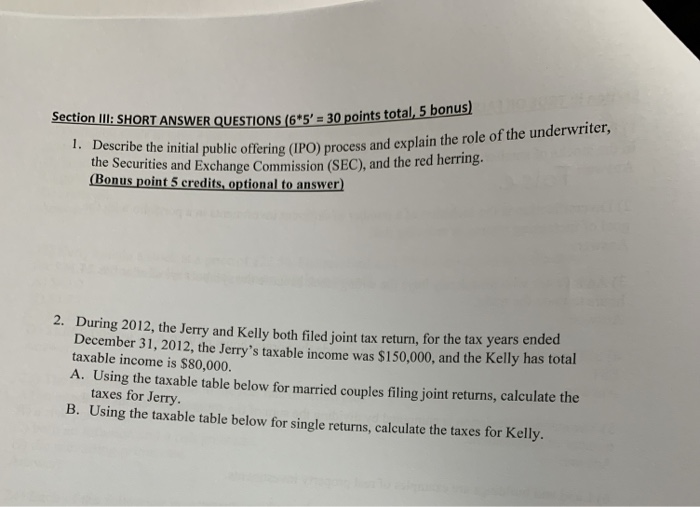

Section III: SHORT ANSWER QUESTIONS (6*5' = 30 points total, fering (IPO) process and explain the role of the underwriter, 1. Describe the initial public offering (IPO) process and exp! the Securities and Exchange Commission (SEC), and the red herring. (Bonus point 5 credits, optional to answer) 2. During 2012, the Jerry and Kelly both filed joint tax return, for the tax years ended December 31, 2012, the Jerry's taxable income was $150,000, and the Kelly has total taxable income is $80,000. A. Using the taxable table below for married couples filing joint returns, calculate the taxes for Jerry. B. Using the taxable table below for single returns, calculate the taxes for Kelly. Section III: SHORT ANSWER QUESTIONS (6*5' = 30 points total, fering (IPO) process and explain the role of the underwriter, 1. Describe the initial public offering (IPO) process and exp! the Securities and Exchange Commission (SEC), and the red herring. (Bonus point 5 credits, optional to answer) 2. During 2012, the Jerry and Kelly both filed joint tax return, for the tax years ended December 31, 2012, the Jerry's taxable income was $150,000, and the Kelly has total taxable income is $80,000. A. Using the taxable table below for married couples filing joint returns, calculate the taxes for Jerry. B. Using the taxable table below for single returns, calculate the taxes for Kelly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts