Question: Section il - Solve the 3 problems below 1. A 20-year 7% coupon bond is trading at 10%% yield. Currently the price of the bond

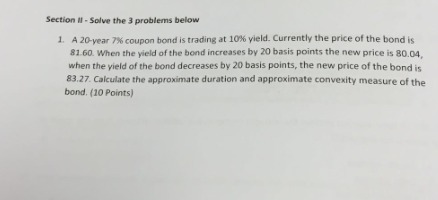

Section il - Solve the 3 problems below 1. A 20-year 7% coupon bond is trading at 10%% yield. Currently the price of the bond is 81 60. When the yield of the bond increases by 20 basis points the new price is 80.04, when the yield of the bond decreases by 20 basis points, the new price of the bond is 83.27. Calculate the approximate duration and approximate convexity measure of the bond. (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts