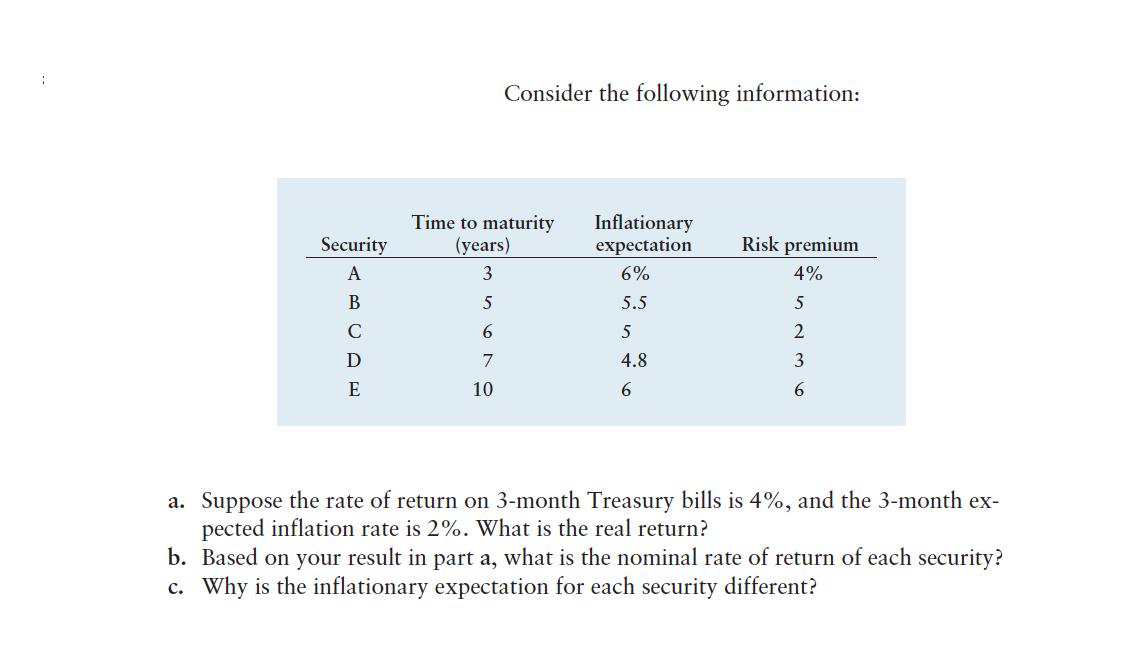

Question: Security A B C D E Consider the following information: Time to maturity Inflationary (years) expectation 3 6% 5 5.5 6 5 7 4.8

Security A B C D E Consider the following information: Time to maturity Inflationary (years) expectation 3 6% 5 5.5 6 5 7 4.8 10 6 Risk premium 4% 5 2 3 6 a. Suppose the rate of return on 3-month Treasury bills is 4%, and the 3-month ex- pected inflation rate is 2%. What is the real return? b. Based on your result in part a, what is the nominal rate of return of each security? c. Why is the inflationary expectation for each security different?

Step by Step Solution

3.30 Rating (165 Votes )

There are 3 Steps involved in it

a 3 Month Treasury Bill Rate of Return 4 3 Month Expected Infla... View full answer

Get step-by-step solutions from verified subject matter experts