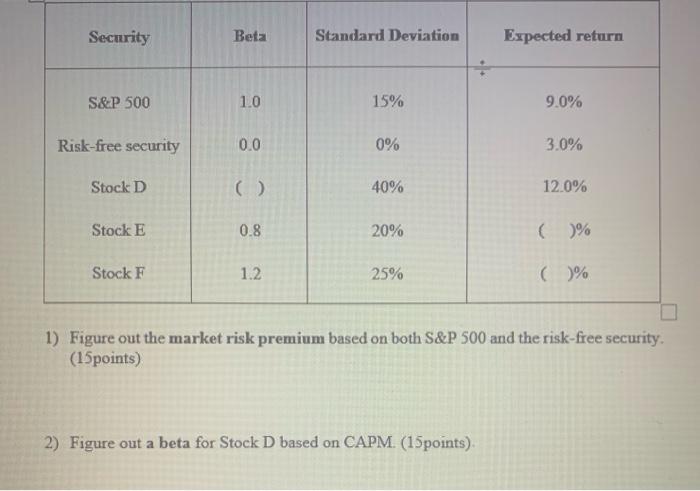

Question: Security Beta Standard Deviation Expected return S&P 500 1.0 15% 9.0% Risk-free security 0.0 0% 3.0% Stock D 40% 12.0% Stock E 0.8 20% (

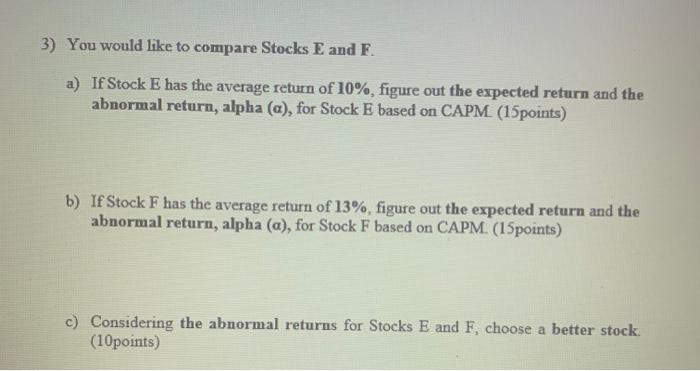

Security Beta Standard Deviation Expected return S&P 500 1.0 15% 9.0% Risk-free security 0.0 0% 3.0% Stock D 40% 12.0% Stock E 0.8 20% ( )% Stock F 1.2. 25% ()% 1) Figure out the market risk premium based on both S&P 500 and the risk-free security (15points) 2) Figure out a beta for Stock D based on CAPM. (15points) 3) You would like to compare Stocks E and F. a) If Stock E has the average return of 10%, figure out the expected return and the abnormal return, alpha (a), for Stock E based on CAPM. (15points) b) If Stock F has the average return of 13%, figure out the expected return and the abnormal return, alpha (a), for Stock F based on CAPM. (15points) c) Considering the abnormal returns for Stocks E and F, choose a better stock. (10points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts