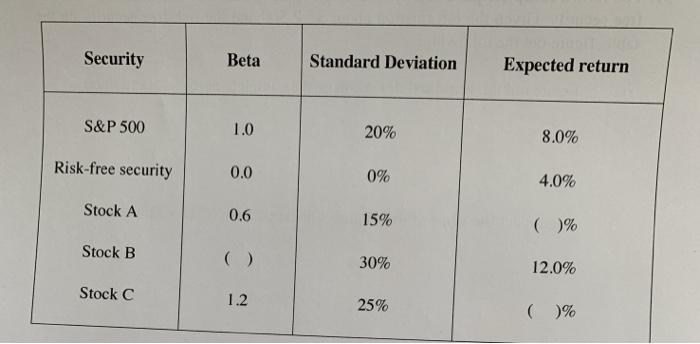

Question: Security Beta Standard Deviation Expected return S&P 500 1.0 20% 8.0% Risk-free security 0.0 0% 4.0% Stock A 0.6 15% ()% Stock B 30% 12.0%

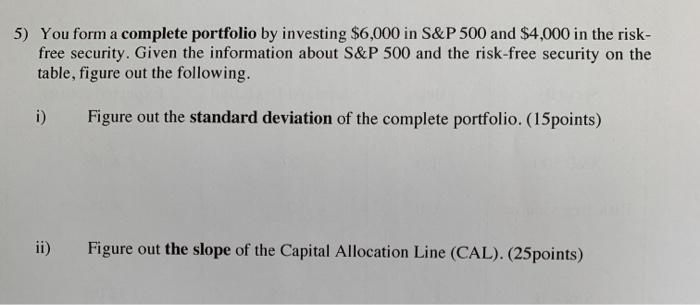

Security Beta Standard Deviation Expected return S&P 500 1.0 20% 8.0% Risk-free security 0.0 0% 4.0% Stock A 0.6 15% ()% Stock B 30% 12.0% Stock C 1.2 25% ()% 5) You form a complete portfolio by investing $6,000 in S&P 500 and $4,000 in the risk- free security. Given the information about S&P 500 and the risk-free security on the table, figure out the following. i) Figure out the standard deviation of the complete portfolio. (15 points) ii) Figure out the slope of the Capital Allocation Line (CAL). (25 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts