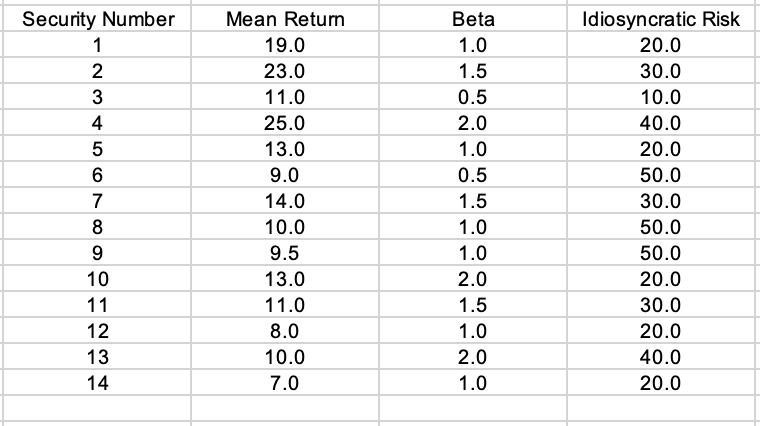

Question: Security Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Mean Return 19.0 23.0 11.0 25.0 13.0 9.0 14.0

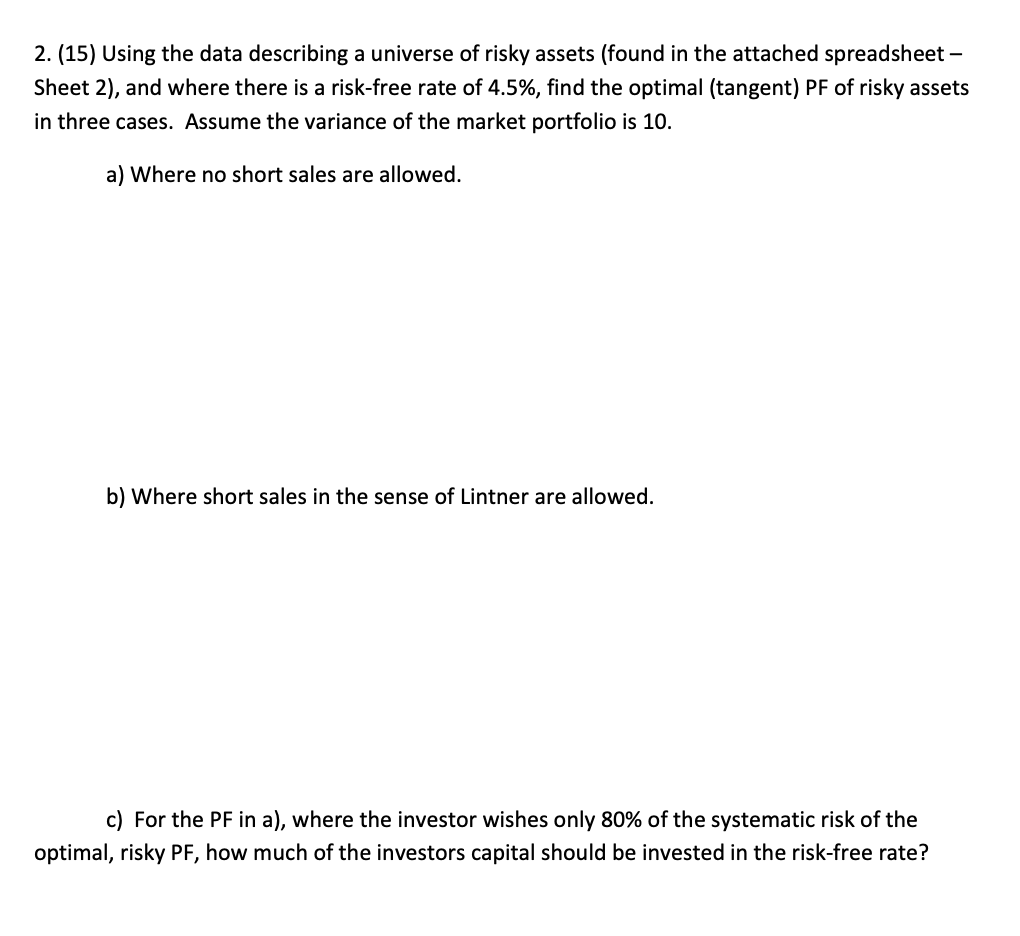

Security Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Mean Return 19.0 23.0 11.0 25.0 13.0 9.0 14.0 10.0 9.5 13.0 11.0 8.0 10.0 7.0 Beta 1.0 1.5 0.5 2.0 1.0 0.5 1.5 1.0 1.0 2.0 1.5 1.0 2.0 1.0 Idiosyncratic Risk 20.0 30.0 10.0 40.0 20.0 50.0 30.0 50.0 50.0 20.0 30.0 20.0 40.0 20.0 2. (15) Using the data describing a universe of risky assets (found in the attached spreadsheet - Sheet 2), and where there is a risk-free rate of 4.5%, find the optimal (tangent) PF of risky assets in three cases. Assume the variance of the market portfolio is 10. a) Where no short sales are allowed. b) Where short sales in the sense of Lintner are allowed. c) For the PF in a), where the investor wishes only 80% of the systematic risk of the optimal, risky PF, how much of the investors capital should be invested in the risk-free rate? Security Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Mean Return 19.0 23.0 11.0 25.0 13.0 9.0 14.0 10.0 9.5 13.0 11.0 8.0 10.0 7.0 Beta 1.0 1.5 0.5 2.0 1.0 0.5 1.5 1.0 1.0 2.0 1.5 1.0 2.0 1.0 Idiosyncratic Risk 20.0 30.0 10.0 40.0 20.0 50.0 30.0 50.0 50.0 20.0 30.0 20.0 40.0 20.0 2. (15) Using the data describing a universe of risky assets (found in the attached spreadsheet - Sheet 2), and where there is a risk-free rate of 4.5%, find the optimal (tangent) PF of risky assets in three cases. Assume the variance of the market portfolio is 10. a) Where no short sales are allowed. b) Where short sales in the sense of Lintner are allowed. c) For the PF in a), where the investor wishes only 80% of the systematic risk of the optimal, risky PF, how much of the investors capital should be invested in the risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts