Question: PR 9 - 6 ( Static ) ( LO 9 . 3 , 9 . 4 ) Determine the intrinsic price per share of common

PR StaticLO Determine the intrinsic price per share of common stock.

points

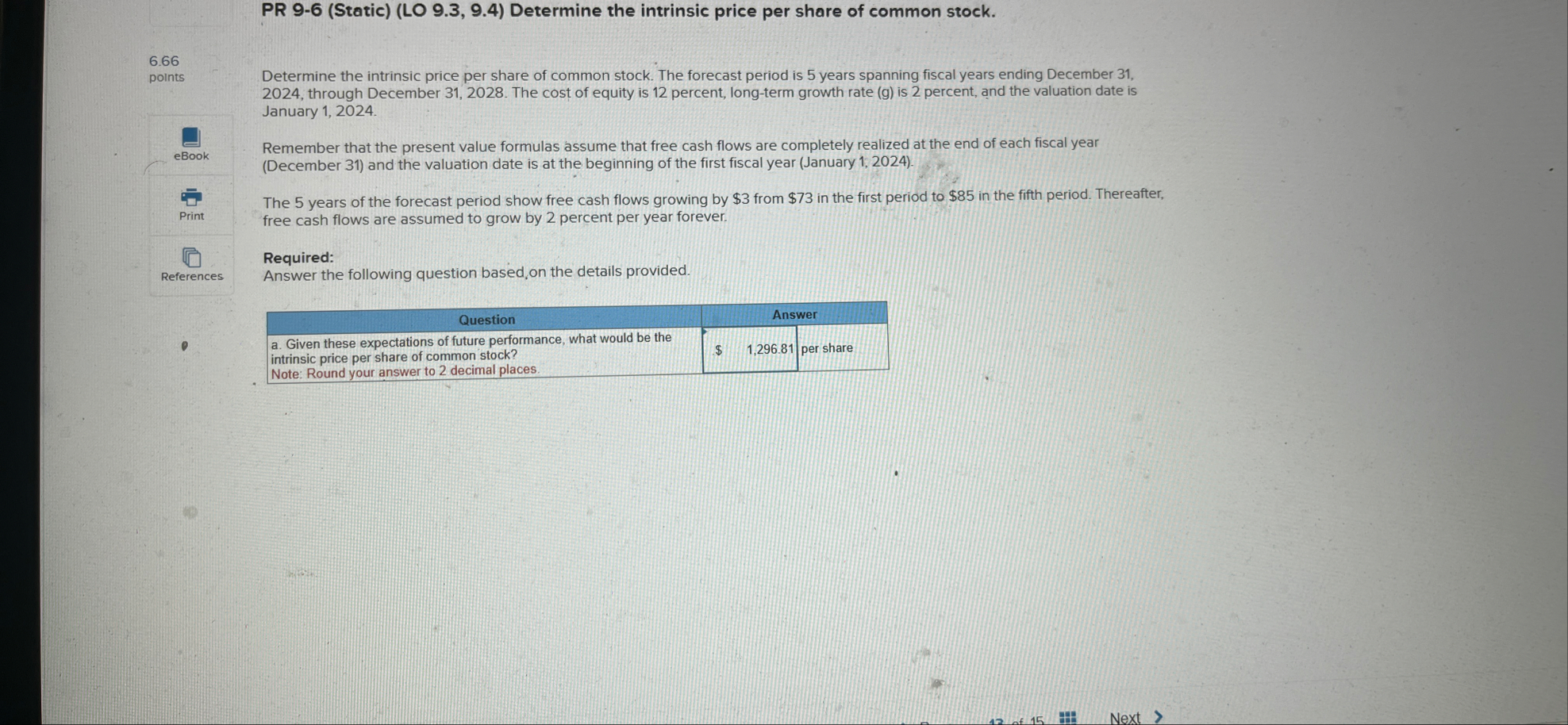

Determine the intrinsic price per share of common stock. The forecast period is years spanning fiscal years ending December through December The cost of equity is percent, longterm growth rate is percent, and the valuation date is January

Remember that the present value formulas assume that free cash flows are completely realized at the end of each fiscal year December and the valuation date is at the beginning of the first fiscal year January

The years of the forecast period show free cash flows growing by $ from $ in the first period to $ in the fifth period. Thereafter, free cash flows are assumed to grow by percent per year forever.

Required:

Answer the following question based, on the details provided.

tableQuestionAnswertablea Given these expectations of future performance, what would be theintrinsic price per share of common stock?Note: Round your answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock