Question: See historical dividend performance for Coca Cola (KO), below. Let's say you need to earn an annual return, r, of 8%. What is a reasonable

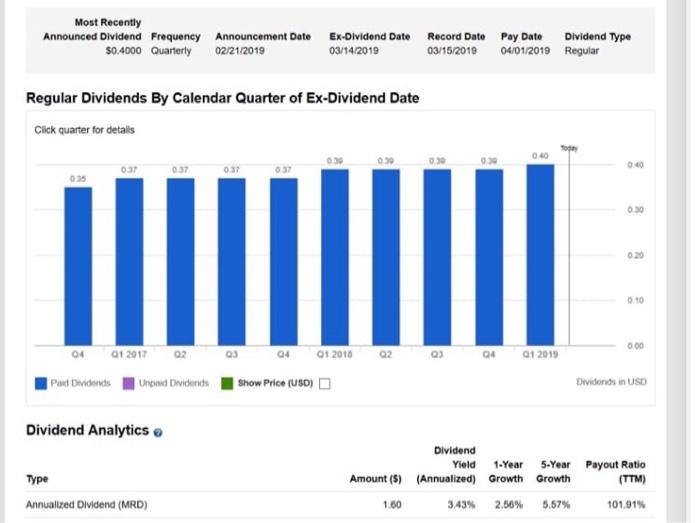

Most Recently Announced Dividend Frequency Announcement Date Ex-Dividend Date Record Date Pay Date Dividend Type 04/01/2019 Regular $0.4000 Quarterly 02/21/2019 03/14/2019 03/15/2019 Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 0.40 0.39 0.39 0.30 0.37 0.37 0.37 0.37 0.40 0.35 0.30 0.10 0.00 04 Q1 2017 03 04 01 2018 02 03 Q1 2019 Pad Dividends Unpad Dividends Show Price (USD) Dividends in USD Dividend Yield 1-Year 5-Year Amount (S) (Annualized) Growth Growth Payout Ratio (TTM) 1.60 3.43% 2.56% 5.57% 101.91% Dividend Analytics. Type Annualized Dividend (MRD) 0.30 04

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts