Question: See historical dividend performance for Coca Cola (KO), below. Let's say you need to earn an annual return, r , of 8%. What is a

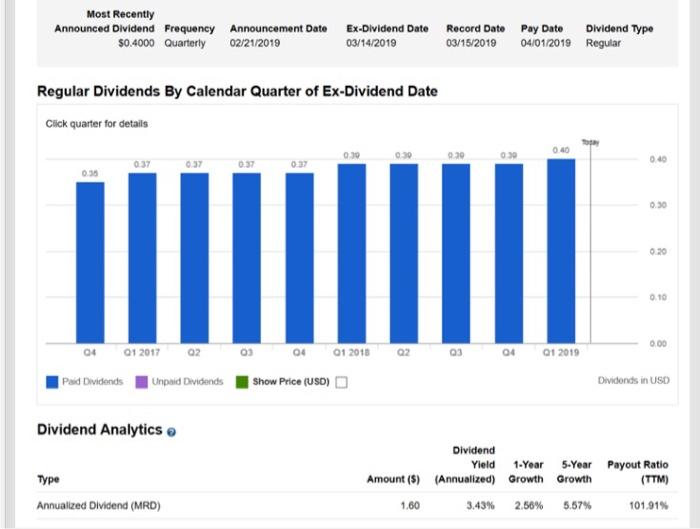

See historical dividend performance for Coca Cola (KO), below. Let's say you need to earn an annual return, r, of 8%.

- What is a reasonable growth rate g to assume for KO? Why?

- What is this stock worth, using the constant growth model and your estimate for g?

- Optional: What's the effect on your valuation of assuming a g that is one percent higher?

Most Recently Announced Dividend Frequency Announcement Date Ex-Dividend Date Record Date $0.4000 Quarterly 02/21/2019 03/14/2019 03/15/2019 Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 0.30 0:39 0.30 0.37 0.37 0.37 0.37 0.35 04 01 2017 02 01 2018 02 03 Paid Dividends Unpaid Dividends Dividend Analytics Type Annualized Dividend (MRD) 03 04 Show Price (USD) Pay Date 04/01/2019 0.40 01 2019 Dividend Yield 1-Year 5-Year Amount ($) (Annualized) Growth Growth 1.60 3.43% 2.56% 5.57% Dividend Type Regular 0:39 04 0,40 0.30 0.20 0.10 0.00 Dividends in USD Payout Ratio (TTM) 101.91%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts