Question: See note 22. Did AF report net interest cost or net interest income in end of the year 2015? 5.5.3 Consolidated balance sheet Assets December

See note 22. Did AF report net interest cost or net interest income in end of the year 2015?

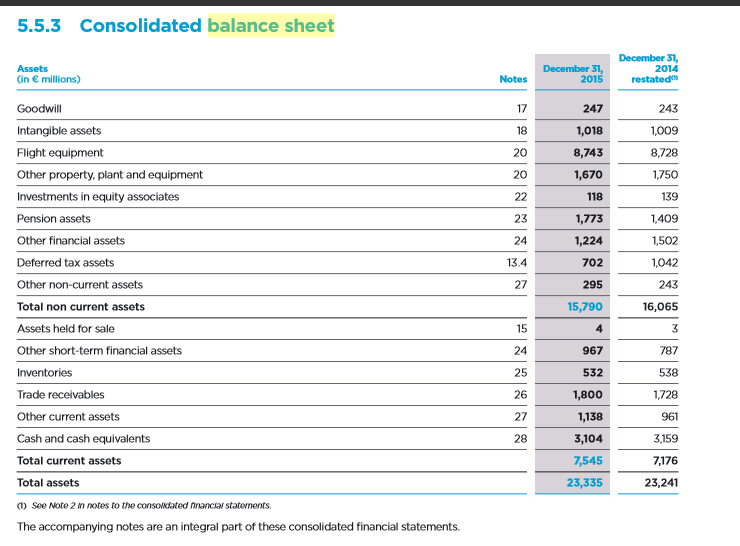

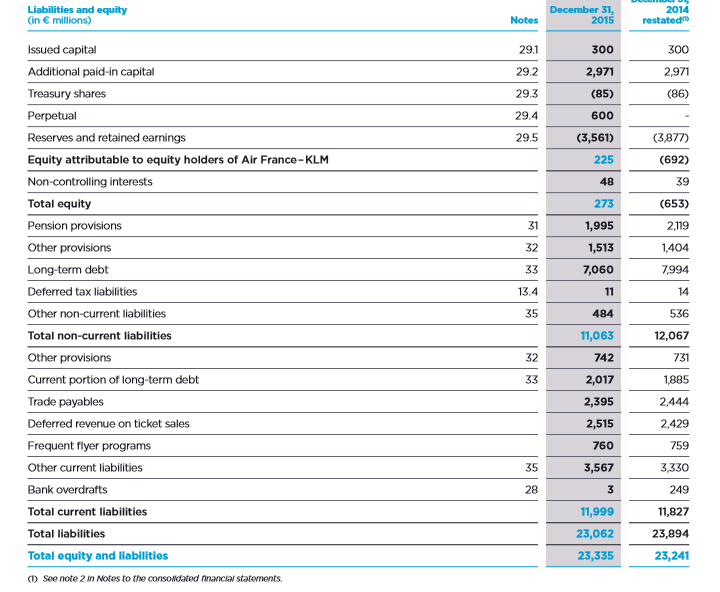

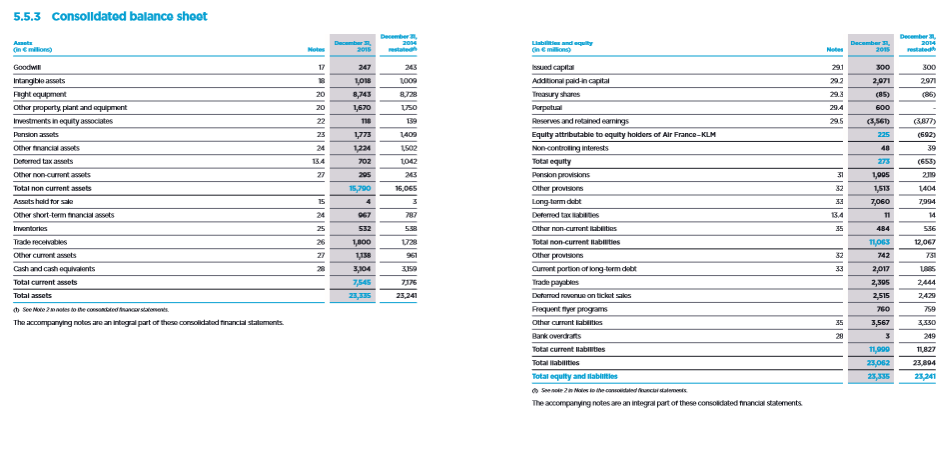

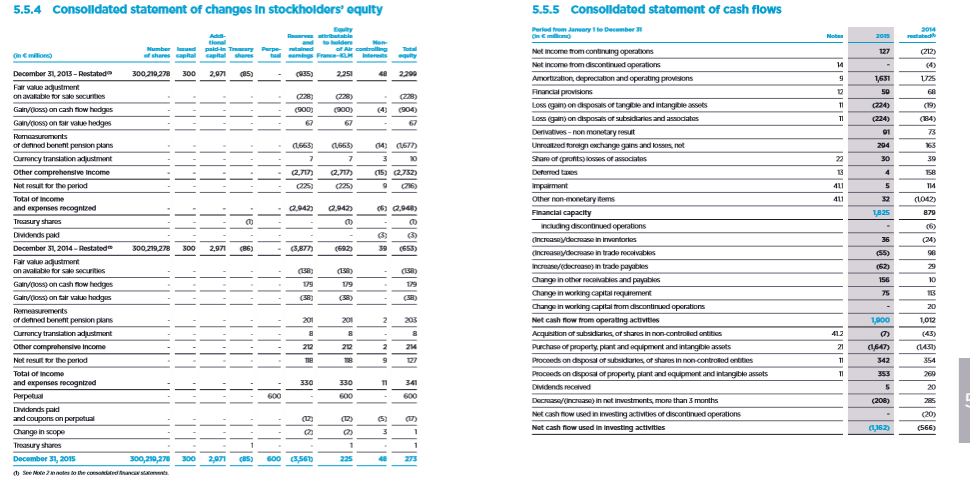

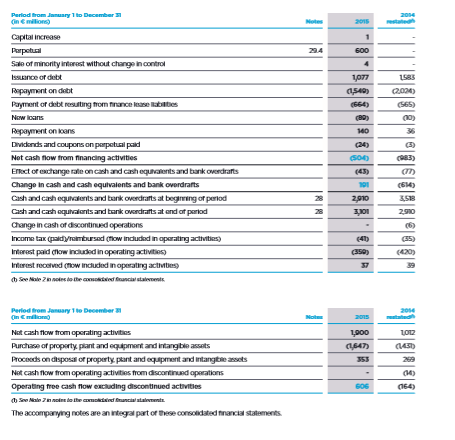

5.5.3 Consolidated balance sheet Assets December 31, December 31, 2014 (In & millions) Notes 2015 restated Goodwill 17 247 243 Intangible assets 18 1,018 1,009 Flight equipment 20 B,743 B,728 Other property, plant and equipment 20 1,670 1,750 Investments in equity associates 22 118 139 Pension assets 23 1,773 1,409 Other financial assets 24 1,224 1,502 Deferred tax assets 13.4 702 1,042 Other non-current assets 27 295 243 Total non current assets 15,790 16,065 Assets held for sale 15 Other short-term financial assets 24 967 787 Inventories 25 532 538 Trade receivables 26 1,800 1,728 Other current assets 27 1,138 961 Cash and cash equivalents 28 3,104 3,159 Total current assets 7,545 7,176 Total assets 23,335 23,241 1) See Note 2 in notes to the consolidated mancial statements. The accompanying notes are an integral part of these consolidated financial statements.Liabilities and equity December 31, 2014 (in { millions) Notes 2015 restated' Issued capital 29.1 300 300 Additional paid-in capital 29.2 2,971 2,971 Treasury shares 29.3 (85) (86) Perpetual 29.4 600 Reserves and retained earnings 29.5 (3,561) (3,877) Equity attributable to equity holders of Air France-KLM 225 (692) Non-controlling interests 48 39 Total equity 273 (653) Pension provisions 31 1,995 2,119 Other provisions 32 1,513 1,404 Long-term debt 33 7,060 7994 Deferred tax liabilities 13.4 11 14 Other non-current liabilities 35 184 536 Total non-current liabilities 11,063 12,067 Other provisions 742 731 Current portion of long-term debt 33 2,017 1,885 Trade payables 2,395 2,444 Deferred revenue on ticket sales 2,515 2,429 Frequent flyer programs 760 759 Other current liabilities 35 3,567 3 330 Bank overdrafts 28 3 249 Total current liabilities 11,999 11,827 Total liabilities 23,062 23,894 Total equity and liabilities 23,335 23,241 (1) See note 2 in Notes to the consolidated mancial statements.5.5.3 Consolidated balance sheet Dooomatter Amanto Labliltion and equity 2014 On & millions? GoodWill 17 247 291 Intangibis assets LOT 1009 Additional paid in capital 2071 2071 Fight equipment 20 8,741 8.72 1851 (85) Other property, plant and equipment 20 1 670 1750 Perpotun 20.4 30 0 Investments in equity associates 22 1:39 Reserves and retained earnings (3877) Pans on Pinots LITE 140 Equity attributable to equity holders of Air France-KLM 125 Other froncal arts 24 1902 Non-controlling interests An 39 154 702 1042 Total Equity 273 Other non-current Erspots 37 Pension provisions 31 2710 Total non current assets 15 790 15065 Other provisors 32 1513 1404 Acents hold for sale 15 Long-for debt 37 7,060 7904 Other short-term mancial assets 24 25 518 Other non-current Itblitios 35 484 26 1.000 172 total con current liabilities ILOG 12 067 Other current isacts 27 961 Other provtions 32 742 Cash and cach equivalents 3104 3150 Current portion of long-term debt 33 2,017 Total current asset 7,545 2,305 2444 Total assets 23 241 Defamed revenue on ticket sales 2 515 2420 Frequent frer programs The accompanying notes are an integral part of these consolidated financial statements. Other current liabilities 35 3.567 Total current liabilities 11827 Total Iabilities 4 062 23 804 Total equity and Ilability 23,335 23 241 The accompanying notes are an integral part of these consolidated financial statements5.5.4 Consolidated statement of changes In stockholders' equity 5.5.5 Consolidated statement of cash flows Period from January 1 to December #1 2014 In ( millicam) Nobu 2015 Number of of shares Net income from continuing operations 212 Net income from discontinued operations Do comber 31, 2013 - Postabode 30 0 310 378 300 2.07 135 3251 2300 Amortization, depreciation and operating provisions 9 1,651 1725 Fair value adjustment. Financial provisions 50 on available for sale securities (228 (228 Gain/Coast on cash flow hodges 1900 1904 Loss caing on disposals of tangible and intangible assets Gain/goss on fair value hedges Loss (going on disposals of subeldiarios and assodates 71 (224) Cerrevives - non monetary result 73 of dunnod bencht pension plans 1.1.1.I. I.I.I. (1655) Unredikeed foreign exchange gains and lossus, not 204 163 Currency translation ad ustiment .1.1.1. Share of qprofitsp losses of associates 30 39 :1.1.I. I.I.I.I. I.I.I. Other comprehensive Income 2.717 2.717 2752) Defened Have 4 158 Not maulit for the panlod 325 mparment 417 5 Total of Income Other ron-monetary Roms 411 1042) and expenses recognized (2 942) (2947) Financial capacity 1.825 879 lal. Treasury Shares . 1.1. inaxingdiscontinued operations Dividends paid 36 (2) December 31, 2014 - Rostated 50 0 219 278 [increase )docmace in trade receivables (55) Fair value adjustment (62) 29 on available for sale securities Increaseqdecrease) in trade payables 10 Gain/goss) on cash flow hodges 179 179 Change in other roombabies and payables 156 Gain/(oas) on fair value hodges Change in working capital requirement 75 20 Bemess rements Change in working Gipital from discontinued operations of defined berent pension plans 201 201 203 Net cash flow from operating activities 1,800 1012 Currency translation adjustment Acquisition of stboldians, of shares in non-controlled entities 1.1. 1.1. 1. 1. 1. 1.1. (7) L.1. I.I.I.I. I.I.I. other comprohensive Income 212 20 Purchase of property plant and equipment and intangible meets 1.1.1. 1.I. 1.I. 1. I. 1. 1.1. I 1. 1.1.1.1. Not mosul for the period Proceeds on disposal of subsidiaries, of shares in non-controlled entities 11 342 354 Total of income Proceeds on disposal of property plant and equipment and intangible assets and oxponsos rocognized 330 330 341 Civiclends received 20 600 600 60 Docressy(nongaze) in not investments more than 3 months 208 285 Dividends paid and coupons on perpetual (12) Net cash how used in investing activities of discontinued operations (20) (5) Not cash flow used in investing activities (1 162) (566) Change in scope Treasury shares Docomber 31 2015 300 28 278 300 2071 600 (3561) 225 273Perlod from January 1 to December 17 Capital Increase 5ain of minority interest without change in control kapayment on debi Payment of debt resulting from finance hisse latinlies 565 Now loans Repayment on loans Dividends and coupons on perpetual paid Not cash flow from financing activities Erkact of exchange told on cash and cash equivalents and bank overdrafts Change in cash and cash equivalents and bank overdrafts Cash and cash equivalents and bank overdrafts at beginning of period 2:010 Cash and cash aquilonts and bank overdrifts at and of period 2010 Change in cash of discontinued operations Income tax goaldyreimbursed (how included in operating activities) Period from January 1 to December Not cash flow from operating activities LOOO Purchase of properly plant and equipment and intangible assets Products on disposal of property pant and equipment and inlang bie assets Not cash flow from operating activities from discontinued operations Operating free cash flow excluding discontinued activities The accompanying notes are an integral part of these consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts