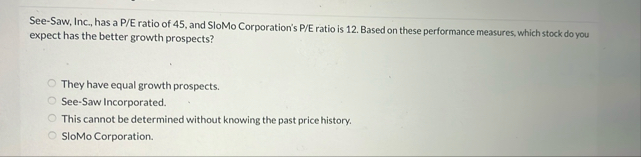

Question: See - Saw, Inc., has a P / E ratio of 4 5 , and SloMo Corporation's P / E ratio is 1 2 .

SeeSaw, Inc., has a PE ratio of and SloMo Corporation's PE ratio is Based on these performance measures, which stock do you expect has the better growth prospects?

They have equal growth prospects.

SeeSaw Incorporated.

This cannot be determined without knowing the past price history.

SloMo Corporation.Netflix, Inc. has a beta of which means that the stock has degree of as the overall market.

a greater; profitability

a lower; volatility

a greater; volatility

a lower; profitabilityWhich stock order is likely to have the most rapid execution?

Margin order

Stop order

Limit order

Market orderCorporate bonds are typically issued in denominations of

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock