Question: See Table 25 m showing financial statement data and stock price data for Mydeco Corp Suppose Mydeco had purchased additional equipment for 512.6 million al

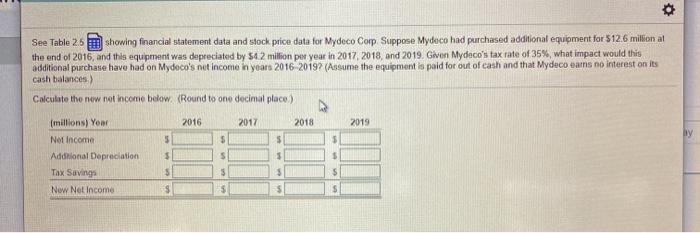

See Table 25 m showing financial statement data and stock price data for Mydeco Corp Suppose Mydeco had purchased additional equipment for 512.6 million al the end of 2016, and this equipment was depreciated by $42 million per year in 2017, 2018, and 2019. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydoco's niet income in years 2016-20197 (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances) Calculate the new not income below (Round to ono decimal place) 2016 2017 2018 2019 $ ly (millions) Your Not Income Additional Depreciation Tax Savings Now Net Income $ $ $ 5 5 $ S $ See Table 25 m showing financial statement data and stock price data for Mydeco Corp Suppose Mydeco had purchased additional equipment for 512.6 million al the end of 2016, and this equipment was depreciated by $42 million per year in 2017, 2018, and 2019. Given Mydeco's tax rate of 35%, what impact would this additional purchase have had on Mydoco's niet income in years 2016-20197 (Assume the equipment is paid for out of cash and that Mydeco earns no interest on its cash balances) Calculate the new not income below (Round to ono decimal place) 2016 2017 2018 2019 $ ly (millions) Your Not Income Additional Depreciation Tax Savings Now Net Income $ $ $ 5 5 $ S $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts