Question: Selby Co. has the following two notes outstanding on Dec. 31, 2018 $10,000, 1 year, 10% note receivable from ABC Co. dated 6/1/19 -

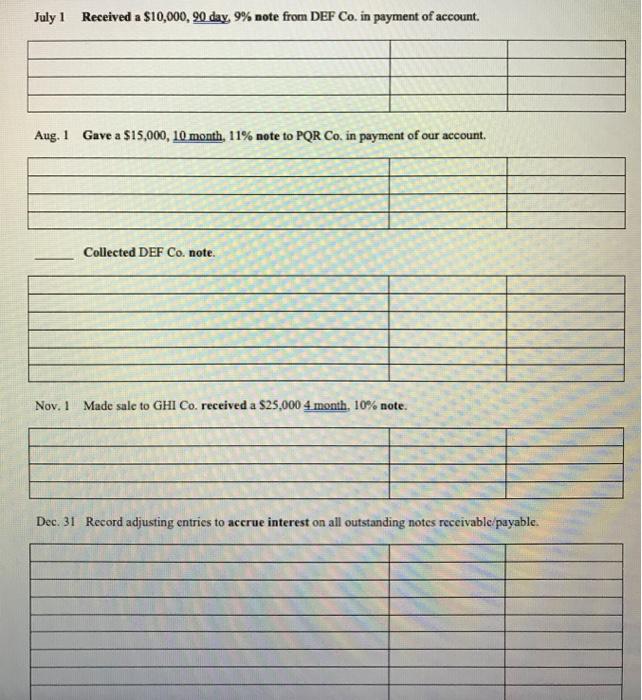

Selby Co. has the following two notes outstanding on Dec. 31, 2018 $10,000, 1 year, 10% note receivable from ABC Co. dated 6/1/19 - $7,000, 6 month, 11% note payable due to JKL Co. dated 9/1/19 Selby uses the estimation/allowance method to handle credit losses. - Prepare journal entries for the following 2019 transactions for Selby Co. (Show all computatio Fill in the date of a transaction if it is not provided.) Paid off JKL Co. note. ABC Co. defaults on their note. Selby expects to collect this amount eventually. Received $2,000 from MNO Co. This account had been previously written off as uncollectible. July 1 Received a $10,000, 90 day, 9% note from DEF Co. in payment of account. Aug. 1 Gave a $15,000, 10 month, 11% note to PQR Co. in payment of our account. Collected DEF Co. note. Nov. 1 Made sale to GHI Co. received a $25,000 4 month, 10% note. Dec. 31 Record adjusting entrics to accrue interest on all outstanding notes receivable/payable.

Step by Step Solution

There are 3 Steps involved in it

Date accounts explanation debit credit 09012019 Note Payable JKL 7000 Interest Payable 700011360171 ... View full answer

Get step-by-step solutions from verified subject matter experts